INFLATION: Transitory or Permanent?

Gas prices nearing $5.00 per gallon are displayed at Chevron and Shell stations on July 12, 2021, in San Francisco. (Justin Sullivan/Getty Images)

The Epoch Times - BY EMEL AKAN October 29, 2021

Inflation is still running high, and many still believe that it’s a temporary post-pandemic phenomenon. However, structural changes taking place in the economy suggest that prices may not go back to normal anytime soon.

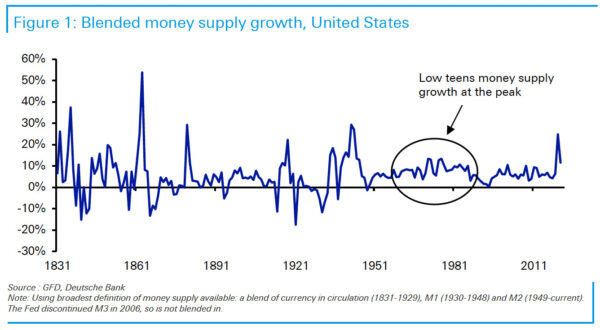

Some economists and investors have argued that excessive stimulus spending and money creation to fight the pandemic are the real culprits causing inflation. They claim that inflation is a product of policy decisions, rather than a coincidence.

Despite the loss of economic output and jobs, U.S. household wealth has surged by a staggering $32 trillion since the start of the pandemic thanks to an unprecedented stimulus that boosted savings and asset values, such as stocks and home values.

The Fed’s balance sheet has swelled by more than $4 trillion as a result of its quantitative easing program, which increased money supply in the economy and encouraged lending. Congress has also allocated about $5.3 trillion in relief to Americans. All of these actions boosted aggregate demand and consumer spending when the economy reopened.

“The result is, you have more money chasing less stuff, and prices are soaring across the board,” Euro Pacific Capital CEO and global strategist Peter Schiff said during the New Orleans Investment Conference in October. “There’s no limit to how much money the Federal Reserve can print. But there is a limit to how much actual stuff the economy is capable of producing.”

While the monthly pace of inflation has slowed in recent months, the year-over-year increase in consumer prices remains stubbornly high at 5.4 percent. Core inflation, which omits changes in more volatile food and energy prices, also rose by 4 percent in September from a year prior, the largest jump in nearly 30 years.

Some of the biggest names in the investment world, including Carl Icahn, Paul Tudor Jones, and David Einhorn, have recently sounded the alarm on persistent price pressures.

“In the long run, we are certainly going to hit the wall” because of money printing, Icahn told CNBC on Oct. 18.

Investors are concerned that the Fed is still behind the curve in reacting to inflation. They fear that the Fed could step on the brake abruptly in the future, plunging the economy into a recession.

“The longer you wait to do something about inflation, the worse it gets,” Schiff said.

A growing federal debt limits a government’s ability to fight inflation. Policymakers are choosing to remain behind the curve as higher interest rates mean that the U.S. government will shoulder a heavier interest burden.

The central bankers are in a tight corner, according to Danielle DiMartino Booth, a veteran of the Dallas Fed and author of the book “Fed Up.”

On Christmas Eve 2018, the U.S. stock market suffered one of its steepest declines in decades, and that “exemplified how very difficult and reticent the markets are about having their liquidity taken away,” Booth said.

It will be difficult for the markets and the economy to handle declining liquidity, especially when the economy starts slowing, she said.

Oil Shocks

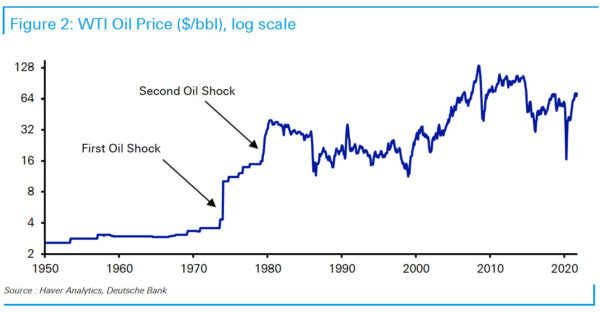

The recent surge in energy, commodity, and food prices has stoked inflation fears, causing many to speculate that we could return to the 1970s, when inflation got out of control.

There were two major oil shocks in the 1970s—triggered by the Arab–Israeli War of 1973 and the Iranian Revolution of 1979—which caused large reductions in the supply of energy. Inflation was already running high during that time, but the twin oil crises pushed U.S. inflation into the double digits. The oil crisis produced many lessons for the United States, one of which is putting more emphasis on reducing foreign oil dependence.

Deutsche Bank analyst Henry Allen said the recent surge in gas prices is “reminiscent of what happened with oil in the early 1970s.”

“As the globe tries to further wean itself off fossil fuels, we could have more energy shocks over the course of this decade,” Allen said in a recent report.

Prices at the pump have soared to $3.39 per gallon for regular gasoline as of Oct. 26, which is more than a dollar higher than they were in October 2020.

“Right now, we’re still a long way from what we saw in the 1970s,” Allen said, but noted that some factors, such as loose monetary policy, a significant level of national debt, labor shortage, and deglobalization “indicate that there are much greater inflationary pressures today.”

Gas was one of the big drivers of inflation in September, rising 42 percent from a year ago. Despite rising oil prices, U.S. producers continue to keep capital expenditure (capex) low, as they’ve been discouraged by current climate policies.

According to Moody’s rating agency, oil exploration and production companies need to invest $542 billion worldwide to avert the next global supply shock.

Similarly, metal prices have surged significantly compared to 2020. High energy costs are prompting smelters to cut back on the production of zinc and aluminum globally.

Awash in cash, many oil, metal, and mining companies have been buying back shares or paying dividends, instead of expanding capital expenditures to tackle supply shortages.

The latest surge in coronavirus infections, especially in Southeast Asian countries, has also led to closures of plants and ports, augmenting supply disruptions in semiconductor chips and other raw materials.

Speaking at a Yahoo Finance summit on Oct. 25, Intel CEO Pat Gelsinger said that “the chip shortage is at its worst right now.”

He expected shortages to persist into 2023, as it takes time for companies to build manufacturing capacity. Automakers have been hit especially hard from this chip supply shock, causing car inventories to go down. Used car prices, one of the largest drivers of inflation in 2021, soared by 24 percent in September from a year ago. New vehicle prices were also up by 9 percent.

Labor Crisis

Besides supply chain disruptions, ongoing labor shortages have become a big problem for U.S. companies. Job openings have raced to record-high levels recently, but many Americans are still reluctant to reenter the workforce.

Sara Gordon, vice president and head of customer success at staffing company Adecco, said the pandemic has led to a paradigm shift in the labor market where employees are now “reevaluating their priorities.”

U.S. workers, who have suffered stagnant wages for years, are now seeing a gain in power. Wages in September rose by 4.6 percent compared with 2020, but still can’t keep pace with rising consumer prices.

The pandemic has also accelerated retirement for baby boomers. Many boomers have made careers in blue-collar jobs, Gordon said, hence their exit is causing the blue-collar labor pool to shrink.

Businesses are expected to continue boosting wages and offering more perks to attract and retain workers. Wage increases are much stickier than commodity prices and are less likely to reverse in the short term, according to analysts, causing more inflationary pressures in the economy.

Rising labor costs and surging demand from restaurants that have reopened have also lifted meat prices in recent months. Beef prices increased by 18 percent over the past year, while pork was up by 13 percent and fresh fish and seafood rose by 11 percent.

“I don’t think it will last,” President Joe Biden said when asked about inflation during a CNN town hall in Baltimore on Oct. 21.

But whether inflation continues into 2022 will depend on whether Congress approves his infrastructure and social spending packages, Biden said.

When asked about high gas prices, Biden blamed the OPEC cartel for not producing enough oil. He later said the answer to the gas shortage is “investing in renewable energy.”

Biden also said he would consider using the National Guard to assist with supply chain and trucking problems.

Backlogs caused by supply chain disruptions around the world have overwhelmed the two busiest U.S. ports, Los Angeles and Long Beach, in recent months. In addition, a nationwide truck driver shortage has further exacerbated supply chain problems, obstructing the ability to move goods across the country and increasing shipping costs.

How Long Is Transitory?

The Federal Reserve says that inflation is elevated mainly because of factors that are “transitory,” and once these factors fade, inflation will drop back toward its 2 percent target.

But the question of how long, exactly, is “transitory” remains unanswered. So far, Fed officials and many economists have failed to forecast inflation correctly. The central bank considerably raised its inflation forecasts for 2021 three times this year.

Wouter Sturkenboom, chief investment strategist at Northern Trust, said the recent spike in prices will prove transitory.

“But we don’t define transitory by length of time,” Sturkenboom wrote in a September report.

Instead, transitory inflation can be fixed, either through the underlying supply and demand conditions being resolved on their own or through intervention, such as the Fed’s raising interest rates to constrict demand, he noted.

Treasury Secretary Janet Yellen told CNN on Oct. 24 that inflation would remain high through the first half of 2022.

The Fed is planning to roll back its $120 billion per month bond-buying program. Fed Chairman Jerome Powell said the central bank is “on track” to complete tapering by mid-2022.

Speaking at a virtual conference on Oct. 22, Powell admitted that “supply-side constraints have gotten worse.”

“The risks are clearly now to longer and more-persistent bottlenecks, and thus to higher inflation,” he said.

Fed officials have repeatedly given assurances that they have the tools to fight inflation, should it become worse. Raising rates is the most effective way for the Fed to control inflation.

Due to higher-than-expected inflation, Fed officials brought forward their time frame for interest rate increases. September projections show that 9 out of 18 officials expect a rate increase in 2022, up from 7 experts earlier.

Emel AkanREPORTERFollowEmel Akan is a White House economic policy reporter in Washington, D.C. Previously she worked in the financial sector as an investment banker at JPMorgan and as a consultant at PwC. She graduated with a master’s degree in business administration from Georgetown University.

COPYRIGHTS

Copy & Paste the link above for Yandex translation to Norwegian.

WHO and WHAT is behind it all ? : >

The bottom line is for the people to regain their original, moral principles, which have intentionally been watered out over the past generations by our press, TV, and other media owned by the Illuminati/Bilderberger Group, corrupting our morals by making misbehavior acceptable to our society. Only in this way shall we conquer this oncoming wave of evil.

Commentary:

Administrator

HUMAN SYNTHESIS

All articles contained in Human-Synthesis are freely available and collected from the Internet. The interpretation of the contents is left to the readers and do not necessarily represent the views of the Administrator. Disclaimer: The contents of this article are of sole responsibility of the author(s). Human-Synthesis will not be responsible for any inaccurate or incorrect statement in this article. Human-Synthesis grants permission to cross-post original Human-Synthesis articles on community internet sites as long as the text & title are not modified