World Economic Forum's Annual Meeting in Davos 2019

'CHINA UNPRECEDENTED DANGER' - Billionaire investor George Soros just went scorched Earth on China during his annual Davos speech

Joe Ciolli Jan. 24, 2019, 5:04 PM

- George Soros, the billionaire investor and chairman of Soros Fund Management, delivered his annual speech at the World Economic Forum's Annual Meeting in Davos, Switzerland.

- Soros absolutely unloaded on China and President Xi Jinping, warning the audience of the "unprecedented danger" the world faces at the hands of the emerging nation.

- Soros also doubled down on comments made during his 2018 address, which saw him criticize "IT monopolies" like Facebook and Google. He believes that their behavior is enabling China's quest for a closed society.

DAVOS, Switzerland — George Soros has made a tradition out of giving a big speech at the World Economic Forum's Annual Meeting.

And based on how the last two years have gone, he's not in the business of making friends — especially not in the Chinese government.

The 2019 version of this — delivered on Thursday evening — featured Soros absolutely unloading on the emerging nation. After briefly greeting attendees, the billionaire investor and chairman of Soros Fund Management launched straight into his prepared spiel.

"I want to use my time tonight to warn the world about an unprecedented danger that's threatening the very survival of open societies," he said.

He continued: "I want to call attention to the mortal danger facing open societies from the instruments of control that machine learning and artificial intelligence can put in the hands of repressive regimes. I'll focus on China, where Xi Jinping wants a one-party state to reign supreme."

And with that, Soros was off and running.

At the center of his anti-China argument was the concept of a centralized database of personal information called a "social credit system."

While Soros acknowledged that such a set-up doesn't yet exist, he said he fears the capabilities afforded by the world's technology heavyweights will hasten its arrival — and, in the process, dismantle what remains of an open society.

The speech was similar in tone to the one delivered by Soros in 2018, which saw him lament the global dominance of tech titans like Facebook and Google. He called them a "menace," and warned that their insatiable thirst for growth could eventually lead them to collaborate with authoritarian regimes like China.

Soros' latest comments pushed that discussion further, and explored the aftermath of a global environment where China's move away from an open society succeeded in full.

"My key point is that the combination of repressive regimes with IT monopolies endows those regimes with a built-in advantage over open societies," Soros said. "The instruments of control are useful tools in the hands of authoritarian regimes, but they pose a mortal threat."

He continued: "China isn't the only authoritarian regime in the world, but it's undoubtedly the wealthiest, strongest and most developed in machine learning and artificial intelligence. This makes Xi Jinping the most dangerous opponent of those who believe in the concept of open society."

What the US can do about the China situation

When President Donald Trump embarked upon his ongoing Chinese trade crusade, Soros was pleased. In his mind, China needed to be challenged before it was too late, and Trump was taking a step in the right direction.

However, according to Soros, the president's follow-through has been disappointing. He noted that Trump's political desires made him more amenable to compromise, while he should've been taking a harder stance.

So what can the US do to play hardball and keep Xi from executing this nefarious closed-society plan? Soros outlined a pair of ideas.

First, he said that the ongoing global trade war should be focused solely on China. While it appears to be fairly targeted at the moment, Soros argued Trump should forget about other nations entirely.

Second, Soros said the US's handling of ZTE and Huawei — the two state-sponsored Chinese companies that recently came under fire for intellectual property theft, among other things — should be fierce. He wants the US to crack down on them.

But Soros' ultimate vision involves some sort of global agreement that puts tensions to rest. Allow him to explain:

"It is possible to dream of something similar to the United Nations Treaty that arose out of the Second World War," Soros said. "This would be the appropriate ending to the current cycle of conflict between the US and China. It would reestablish international cooperation and allow open societies to flourish."

George Soros - Davos 2019 - Investing Hedge Funds

Jean-Philippe Courtois - Executive Vice President Microsoft

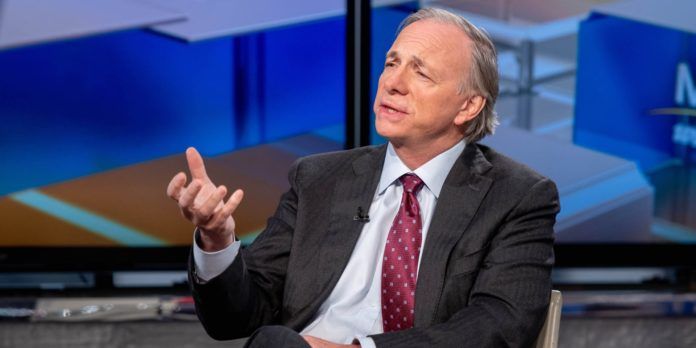

Legendary billionaire Ray Dalio told a crowd at Davos that the next economic meltdown scared him more than anything .

At this point it’s been all but accepted that an economic recession will strike at some point before the end of 2020. And Ray Dalio is among those resigned to this fate.

The founder and cochief investment officer of Bridgewater Associates — the world’s largest hedge fund — said as much during a panel this week at the World Economic Forum’s Annual Meeting in Davos, Switzerland.

It’s well-traveled territory for any follower of Dalio’s punditry over the past several months. He thinks we’re in the seventh or eighth inning of a short-term debt cycle, which will need to be unwound in painful fashion.

But Dalio is worried by external forces, the drivers that exist beyond what we’d normally associate with a recession. He’s specifically referring to political and social issuescomplicating matters in the US and abroad.

Dalio argues that when it comes time for the Federal Reserve to step in and ease conditions once again — something it’s repeatedly done over time to stimulate postcrisis growth — all bets will be off.

“In the US, there will be a significant slowing in that particular period,” Dalio said Tuesday during a panel discussion hosted by Maria Bartiromo of Fox Business. “The bigger issues really are connected to politics and the economic policies associated with that.”

At the root of Dalio’s view is the immense debt load that US companies have accumulated over the past decade. It’s a reckoning that will come due sooner rather than later as borrowing costs rise, and Dalio doesn’t expect it to be pretty.

When conditions do start to go south, that could coincide with divisive political developments, amplifying the market’s struggles. With respect to this, Dalio mentioned the 70% marginal income tax on the super wealthy recently floated by Rep. Alexandria Ocasio-Cortez, though he didn’t mention the politician by name. He was simply highlighting it as an example of something that could stir up social strife and serve as a headwind for companies.

As for when it comes time for the US to claw out of its next economic hole, Dalio warns the nation could be hamstrung relative to history, at least with respect to interest-rate hikes. In fact, the ordeal reminds him of the era surrounding the Great Depression.

“We have limitations to monetary policy, which is our most valuable tool,” Dalio said. “At the same time, we have greater political and social antagonism. That’s why the next downturn in the economy worries me the most.

“There are a lot of parallels between now and the late 1930s. From 1929 to 1932 we had a debt crisis — interest rates hit zero. Then there was a lot of printing of money, and purchases of financial assets brought their prices higher. That also creates a polarity, a populism, and an antagonism.”

Going beyond what conditions will surround the next major US economic downturn, Dalio is acutely focused on China and how it will deal with the end of its own cycle.

Put simply, Dalio thinks the emerging nation will be just fine in the long term, largely because its monetary policy is denominated in Chinese yuan.

“The debt is in their currency,” Dalio said. “They can handle that cycle. But there’s a weakening there.”

But a short-term debt crisis will still sting, he argues. If you want to do business in China going forward, its enormous debt burden will flare up at some point, even if it eventually gets worked out.

“If you were to take a two-, three-, four-year perspective, that’s going to be an issue,” he said. “I do think that capital flows, and the nature of that balance-of-payments issue, is going to be a factor in the years ahead. But whenever you’re having a deleveraging, that’s something that makes the country healthier.”

Ray Dalio - Davos 2019 - Bridgewater Associates