"Never Seen In Over 40 Years" - SVB Collapse Sparks Bank Runs As People Wait In Lines

BY Zero Hedge - TYLER DURDEN - SUNDAY, MAR 12, 2023

Friday morning's seizure of Silicon Valley Bank by the Federal Deposit Insurance Corporation (FDIC) underscores the banking sector's vulnerability, exposing the Federal Reserve's lack of foresight in combating inflation through aggressive interest rate hikes that have caused regional banks to crumble.

As venture capitalists and others with inside knowledge panicked and withdrew a staggering $42 billion in deposits before SVB's collapse, an old-fashioned bank run reminiscent of the one in the classic 1946 film "It's a Wonderful Life" has ensued, involving ordinary people.

Let's go down memory lane and revisit the bank run scene from the movie.

The velocity at which elite investors and depositors removed $42 billion from SVB on Thursday is truly impressive, causing the most significant US bank failure since the financial crisis just one day later. Unfortunately, small banking clients had insufficient time to withdraw their funds, leaving their unsecured deposits likely lost, and the FDIC only provides protection for deposits of up to $250,000.

This is what a digital era bank run looks like https://t.co/s7Ex17Dk84 March 12, 2023

On Saturday, just like the bank run scene from It's a Wonderful Life, images and videos surfaced on social media of people lined up outside SVB branches and other SVB-exposed banks, trying to panic-withdraw as much money as they could.

Shades of 1930’s. This is my bank in Wellesley this morning. Boston Private Bank, recently acquired by Silicon Valley Bank. Ruh, roh. pic.twitter.com/MAD46ozShx March 10, 2023

Bankrun in the US #SVB pic.twitter.com/HbMmR2dLge March 11, 2023

I’ve never seen a bank run in Brentwood Los Angeles in over 40 years — this is at first republic bank branch. People standing in rain pic.twitter.com/k31PqqpyO3 March 11, 2023

On Sunday, Treasury Secretary Janet Yellen said banking regulators are working to resolve failed SVB with a focus on depositors but didn't elaborate on details.

Yellen told CBS's "Face the Nation" that despite SVB's collapse, the US banking system remains safe, well-capitalized, and resilient. She said officials are "working to address this situation in a timely way."

Meanwhile, as Jason Calacanis writes, this might be the beginning.

ON MONDAY 100,000 AMERICANS WILL BE LINED UP AT THEIR REGIONAL BANK DEMANDING THEIR MONEY — MOST WILL NOT GET IT

THIS WENT FROM SILICON VALLEY INSIDERS ON THURSDAY TO THE MIDDLE CLASS ON SATURDAY — MAIN STREET FINDS OUT MONDAY March 12, 2023

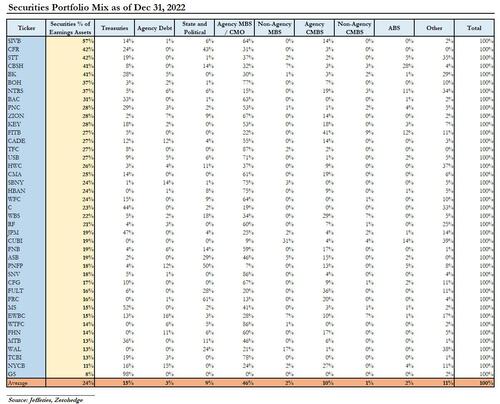

The question we posted yesterday to premium subs: "Was Silicon Valley Bank Really Unique, And Who Is Next."

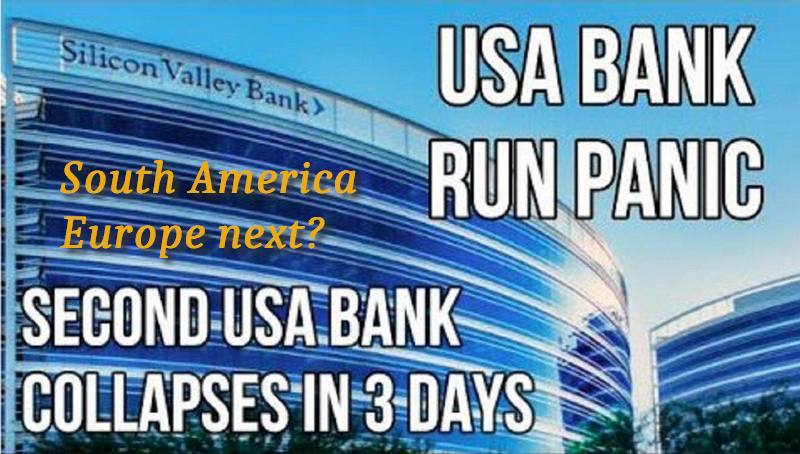

And while all US banks parked some part of their money in Treasuries and other bonds that dropped in value last year thanks to the Fed's fastest rate hiking campaign since Volcker, SVB took it to an entirely new level: as Bloomberg notes, SIVB's investment portfolio swelled to 57% of its total assets. As the chart below shows, no other competitor among 74 major US banks had more than 42%.

As fear spreads this weekend, even more people will likely be lining up in front of these regional banks on Monday morning.

... and Monday it is.

From a source I trust: @SVB_Financial depositors will get ~50% on Mon/Tues and the balance based on realized value over the next 3-6 months. If this proves true, I expect there will be bank runs beginning Monday am at a large number of non-SIB banks. No company will take even a… https://t.co/2BoqtCDKJt March 11, 2023

Zero Hedge - TYLER DURDEN