The Truth Nobody is Telling about the U.S. Economy

— Presented by Rogue Economics —

Ph.D. An economist who directed the elite team at Goldman Sachs reveals:

“Today, I’m revealing a surprising truth nobody in the mainstream media will admit to.

America’s economy will never return to ‘normal.’ Here’s why…”

– Nomi Prins, Investigative Journalist

What if the next crisis is nothing like the last?

Would you be surprised if it’s not a crash…

Or a crushing depression…

But something far more unusual?

Our guest tonight is convinced the next crisis will play out in a strange way nobody sees coming.

It won’t be a crash… an inflation crisis… or anything like we’ve seen before.

In the past, she believed an epic crash would crush investors who held on too long…

But now, she’s discovered new information that has changed her views completely.

She says:

“Our fragmented society is at a crossroads… many will be left behind, but a lucky few will become richer than they’ve ever imagined possible.”

And today, for the first time, she’s coming forward with a stunning new prediction.

Over the past 20 years, renowned author Nomi Prins has leveraged her experience at some of America’s biggest financial firms – including JPMorgan Chase, Bear Stearns, and Goldman Sachs.

Along the way, she’s built a global network of insiders – at the highest levels of power. And she’s gained a unique understanding of what’s really happening in the financial markets.

Today she says the truth of what’s really happening… it’s MUCH stranger than you think.

I’ve asked Nomi to join us today… to explain what’s going on… and why she says we’re about to witness the greatest wealth transfer in the history of America – a $150 trillion anomaly she calls ‘The Great Distortion.’

As you’ll see…

Understanding the details of this strange event could mean the difference between a long, relaxing retirement…

And years of frustration… and regret.

Grab a pen and paper…

You’re about to find out how you could position yourself to capture your share of this $150 trillion event...

Hi, I’m Chris Hurt.

If the talking heads in the mainstream media have you seeing ghosts of 2008…

You’ll want to pay close attention to today’s guest.

A former Wall Street managing director who walked away from a million-dollar career, Nomi Prins is now a prolific author and one of the world’s most respected investigative journalists.

You might recognize her from appearances on Fox Business… CNBC… Bloomberg… PBS… or CSPAN…

She’s here today to expose a bombshell story about a strange phenomenon in our financial system…

A $150 trillion transfer of wealth she calls "The Great Distortion", could soon trigger a historic windfall for some Americans…

While crushing the retirement dreams of many more.

Hi Nomi. Thanks for coming on with us today.

NOMI

Hi Chris, thank you so much for having me.

CHRIS

Nomi, I understand you have a bombshell story to share with us… but before we get into that, I’d like to ask you about something you wrote back in 2018…

NOMI

Sure…

CHRIS

In your best-selling book, Collusion, you made a scary prediction – I’ve underlined it here:

Basically, you said we’re facing the threat of a collapse bigger than the 2008 financial crisis…

But now I’m told you’re taking this prediction back? Is that right?

NOMI

Wow… A shot to the gut right out of the gate… Thanks for that, Chris.

The short answer is yes… A lot has changed since I made that prediction.

And today, the last thing I’m worried about is a market crash.

CHRIS

The last thing?

Well, now you have some explaining to do. I think a lot of folks would disagree with you right now. After all…

Didn’t Netflix recently crash by something like 20% in a single day… ?

And Facebook plummeted 26%…

NOMI

You’re right, Chris. And Peloton’s stock tanked by 25% in just 15 minutes – only to soar 25% higher – turning in its best day ever the very next week.

When you add in the turbulence of the conflicts overseas, it’s no wonder so many folks think we’re headed for a crash.

It’s definitely feeling a lot like 2008 out there.

Seems like every week, there’s a new warning of a downturn, a crash –

CHRIS

And yet – you’re predicting something completely different…

NOMI

Chris, we all know the mainstream media will say anything for more viewers and clicks…

But folks who are distracted by this kind of propaganda are about to be left behind.

CHRIS

Left behind?

So you’re making a new prediction.

NOMI

Chris, the media is right about one thing – we are about to witness a huge economic crisis…

But not the kind of crisis most people expect.

CHRIS

So not a repeat of 2008…

NOMI

No – this is unlike anything we’ve ever seen before.

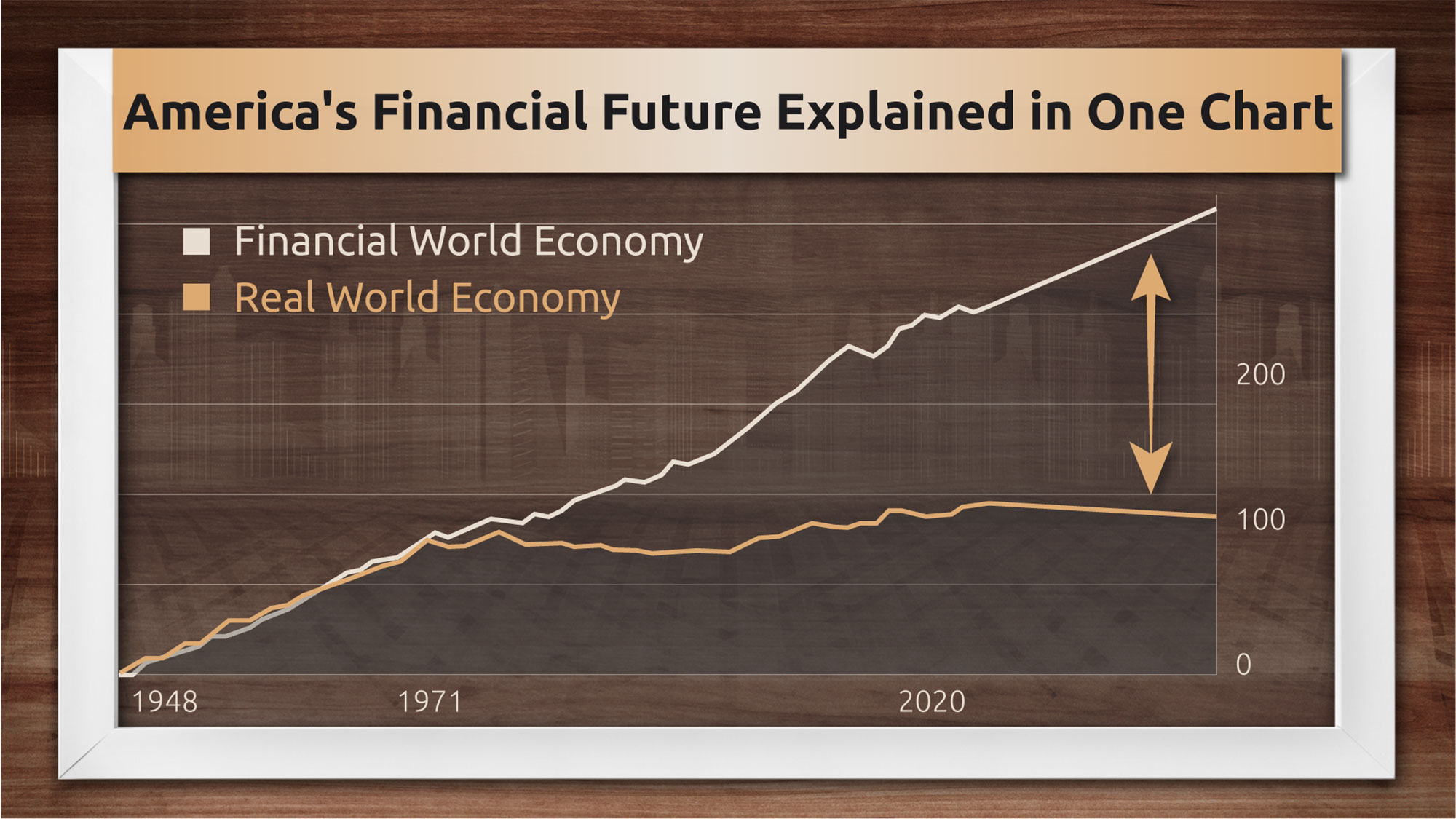

The best way to show you, I think, is with a picture.

CHRIS

Yeah – I think we have it up on the screen now… So what exactly are we looking at here?

NOMI

Everything about life in America today can be explained in this one chart…

CHRIS

One chart… everything?

NOMI

Everything…

From the election of Donald Trump – to the rise of AOC.

The toxic political climate of today…

The soaring price of gasoline… tuition and health care…

Even the wild, unpredictable shortages you’ve seen at the store…

It also explains why most people – save for the rich – are struggling right now.

Chris – this chart may not look like much to you...

But to me, it’s both terrifying and explanatory.

CHRIS

OK – so all I see are a couple of lines. Why does this have you so worked up?

NOMI

What you see here is a perfect example of something I call a “Distortion.”

In this case, it shows how far the financial world has drifted from reality.

Do you see how these lines started out together – then steadily grew apart?

CHRIS

Yes… the gap gets wider all the time.

NOMI

If this chart was measuring the “closeness” of a married couple… what would you think?

CHRIS

Me? I’d say they’re in trouble… they’re drifting apart… maybe a divorce is inevitable.

NOMI

Right… a kind of permanent separation.

Of course, this chart doesn’t measure the health of a marriage…

But it does show two data points that were ONCE together… but have since drifted far apart.

The top line represents the growth of our financial economy… Wall Street… Silicon Valley… the so-called “elites”

The bottom line – that’s the growth of our wages… which you might call the real-world economy.

So to use your words, Chris…

CHRIS

Oh I think I see what you’re saying…

The financial world is now divorced from reality?

NOMI

Right.

And the worst part is, most people – they’re hoping life will get easier and betting their retirement… their lives… their careers – on a return to sanity.

But that’s a losing bet, Chris.

If you think things seem “unreal” now…?

Just wait!

Life for most people is about to get much stranger – and even more confusing.

CHRIS

Wow, Nomi… so you just hit us with a ton of bricks.

Are you saying we have to rethink everything?

That the chaos we’re seeing across America is somehow permanent?

NOMI

By the time we go off the air today…

I promise you’re going to see the world in a totally different way… a much more accurate way. It may feel uncomfortable and different from what you’re used to – but it will help you make sense of the strange events to come.

CHRIS

OK – I guess I’d rather know what’s coming and brace for it – than be the one who gets blindsided, that’s for sure.

Now, can we put the chart back up for just a second…?

Thanks.

I’m curious…

On the left side, the origin point, so to speak.

You called it the ‘real’ economy and the ‘financial’ economy, right? What caused them to disconnect like that?

And – I’m afraid to ask – but what’s going to happen next?

NOMI

Those are serious questions, Chris…

And I’m going to answer every single one.

But first…

Chris, I have a question for you…

CHRIS

Sure…

NOMI

I’m willing to bet that you… and most of the folks watching “followed the rules,” so to speak.

I mean… you went to college… you got a job… you worked hard… maybe you got promoted… you saved money… invested wisely.

You followed all those “rules.”

Yet STILL, you’re falling behind.

Does that feel familiar to you?

CHRIS

Well for me? Yes… I don’t like to think about it. But yeah – I think most people feel this kind of stress – like they’re running on a treadmill.

Are you telling me this chart explains why?

NOMI

It does…

And it all traces back to your question – what caused the ‘split’ in our economy?

You don’t have to be a historian to “get” what’s going on…

But for just a moment, let’s travel back to the 1970s…

Late in his presidency, Richard Nixon was in trouble.

He was fighting a massive war in Vietnam…

Can you guess how he “paid” for it all?

CHRIS

I’m guessing he raised taxes quite a bit.

NOMI

Well, Nixon certainly could have pushed Congress to raise taxes… but he didn’t.

CHRIS

OK… so then, maybe he borrowed billions of dollars…

NOMI

Good guess… but it turns out, he did something no President had ever done before. (Or since.)

He distorted the U.S. dollar.

CHRIS

Meaning?

NOMI

He took America off the gold standard.

CHRIS

And that kicked off a corresponding distortion in our economy?

NOMI

A massive distortion.

Take a look at this…

Do you see what happened – starting in 1971?

CHRIS

Wow… It looks like the chart spikes right there!

NOMI

Exactly. What you’re looking at is the U.S. money supply.

So from that point on, an explosion of new money flooded into the economy.

Which on the surface may sound like a good thing.

But where did all that cash go?

It didn’t go to you…

Or me…

Or to our parents…

Now let’s quickly go back to the first chart...

Do you notice a pattern?

CHRIS

Oh… Well yeah. I think if I’m reading this right… the financial world – Wall Street – starts pulling away from Main Street – at the very same time!

NOMI

Exactly... 1971.

CHRIS

OK – so something went “screwy” back in 1971.

But Nomi… that was 50-plus years ago.

How is that relevant to our viewers here today?

NOMI

That’s a great question.

It may seem like a distant memory…

But 1971 was a pivotal moment in history most people don’t know about.

Almost like the dividing line between “B.C.” and “A.D.” – when it comes to our money.

And the world has never been the same since.

Ever since this moment… the so-called “Nixon Shock”…

No matter how hard we work…

No matter how much money we save…

No matter how careful we are with our investments…

Most people have fallen behind.

And I fear this is only going to get worse for many Americans…

But for people who know what to do… it could hand them a lot of cash in the months ahead.

CHRIS

You know, I was just thinking about how most people used to dream about earning a six-figure salary.

Well… even a six-figure income is not what it used to be…

Income just doesn’t seem to keep up with the cost of housing… education… food…

NOMI

Chris… has the price of anything gone DOWN since 1971?

CHRIS

Huh… Now that you mention it. I can’t think of anything. Except for maybe disco records!

NOMI

[Laughs] Right. Saturday Night Fever is on sale.

CHRIS

So let me guess… is your big prediction today higher prices and out-of-control inflation?

NOMI

No… not at all. That’s been happening for decades…

Prices have risen higher and higher

Houses… cars… medical costs… just about everything is more expensive.

But the huge distortion I’m warning about today is much, much bigger...

And it will have a far more profound effect on your life than ordinary inflation.

CHRIS

Bigger than spiraling inflation and crushing debt?

NOMI

Much bigger, Chris. That’s why I call it "The Great Distortion".

As you’ll see in a moment… "The Great Distortion" is already altering the fabric of society like nothing we’ve ever seen before. Everything from:

- The way we travel…

- How we invest…

- Where we live…

- And what we do for work and play.

Even the appearance and function of our money could change in the next 12 months as the Great Distortion comes into focus – and, I’m going to show you exactly how to position yourself to profit.

Look, the simple fact is… every single facet of our lives is being disrupted by this $150 trillion distortion in ways most folks can’t even imagine.

Some could be enriched beyond their wildest dreams…

While everyone else will likely be left behind, stuck in a sort of permanent underclass.

And that’s what makes today a make-or-break moment for investors.

Chris – if you simply do what you’ve been told to do all these years, you’re going to be very badly hurt.

Most people, I fear, will slip into poverty and never recover.

Think about this for a second…

Even if you somehow got a 10% raise every year – you’re still falling behind.

Since 2008, housing has soared by 124%…

And the cost of a college degree is an incredible 53% higher.

CHRIS

Not to mention today’s prices for food and gas.

Nomi, are all of these distortions – housing, education, food, gas... they’re all here to stay?

NOMI

They’re here to stay, and they’re going to get even more extreme.

For most folks, the Great Distortion will be a disaster. But those who understand where the money will go next could capture more wealth than they ever thought possible.

CHRIS

And you know where this $150 trillion is going to flow?

NOMI

Of course… I may have walked away from my position at Goldman Sachs, but I still keep my ear to the ground of the big firms I used to work for. There are a handful of ‘insiders’ I still talk to.

I also hold frequent meetings to discuss the workings of Wall Street and the economy with leaders in Washington.

I’ve provided my expert opinion on legislation and regulatory matters across the aisle.

Recently, I was invited by Senator Bernie Sanders to testify before the Senate Budget Committee.

Following that, I had a long discussion with Senator Toomey’s office about Great Distortion.

What I’ve learned is going to shock most people…

It’s the reason why I say we’re NEVER going back to normal.

It’s the reason why I’ve been invited to meet with the folks at some of the most powerful organizations in the world, like…

- Federal Reserve officials…

- The International Monetary Fund…

- The World Bank…

- The United States Senate

- The Tokyo Stock Exchange…

- … and The London School of Economics…

– working so hard to help people take charge of their money.

And prepare for what’s coming…

CHRIS

Nomi, before you show the viewers at home where the money is going – I’d like to know… why do you say we’re never going back to normal?

NOMI

Ever since 1971, life has been getting harder for most people.

Sure we have more gizmos and gadgets and billionaires are shooting themselves into space.

We have more “money” than at any point in history.

And yet it’s never been harder to keep up.

CHRIS

I think most folks would agree…but why is it getting harder?

NOMI

The reason is simple…

All that money being printed and funneled into the economy is not falling like snow… it’s not being spread evenly.

It’s piling up in certain places… like Wall Street.

CHRIS

Of course… the rich always get richer.

NOMI

Do you remember the Great Recession, back in 2008 – when we handed trillions of dollars to banks that were ‘too big to fail?’

The regulators warned Americans if we didn’t bail out the banks, we’d have a full-scale collapse…

CHRIS

I remember that…

NOMI

Did you get any of that money?

CHRIS

I don’t recall getting a check in the mail.

NOMI

Of course not… most of that money stayed on Wall Street.

Not only did the bailouts line the pockets of Wall Street and gut the real economy…

They made the distortion much, much worse.

CHRIS

OK… so if I’m hearing you right, this distortion began five decades ago. It’s made life in general much more difficult for most of us.

And now it’s getting worse?

NOMI

Think about it, Chris…

When was the last time things felt ‘right’ in America?

We’ve seen massive protests – fires and looting in the streets. A huge trucker convoy clogging the streets of Washington DC.

We’ve seen wild and unpredictable shortages of everything from toilet paper to automobiles.

Along with lumber, eggs – even the copper penny has been distorted… It’s now worth three cents thanks to the soaring price of copper.

But one key driver of our economy has become more plentiful than ever…

Let’s take a quick look at another chart…

Do you see the arrows I’ve drawn?

The green arrow shows money supply before the Great Recession…

CHRIS

Pretty flat…

NOMI

Right… Now, look at the red arrow... do you see what happened in 2008?

CHRIS

The chart suddenly spikes higher… why?

NOMI

That was Fall of 2008 – October 3rd, to be exact – the day the Federal Government bailed out the banks.

But that’s not all they did.

Over the next 12 years, the Fed printed so many dollars, our money supply doubled by 2020.

In other words, our government hasn’t tapped the brakes on the printing press in any meaningful way since 2008.

That’s why, today, it’s becoming harder and harder for Americans to make ends meet.

There’s simply no way to get ahead of this by ‘earning’ money in a job...

CHRIS

I’ve got to wonder – if that’s true – maybe that’s why so many people have thrown up their hands and “quit.”

I saw a report by CNBC that said 4.3 million Americans quit their jobs in a single month!

NOMI

You’re right, Chris.

And that was just one month. More than 4 million people have walked out on their jobs every single month since late last year.

It’s simple math…

Why would you work hard… take time away from your family… in a soul-crushing job – if the price of the things you want to buy is soaring faster than you can earn money.

If your daily lunch goes up by 10% - are you guaranteed a 10% raise?

Or if the cost of your commute zooms 20% higher – is your boss somehow going to match that?

CHRIS

I doubt it!

NOMI

Of course not!

That’s why most people are falling farther behind. At this point, they’d be lucky to “tread water,” because of the Fed’s exponential money printing.

So if you keep doing what you’re doing – expecting the world to “make sense” – you’re going to be in for a lot of pain in the weeks ahead.

CHRIS

I couldn’t even begin to guess… I know a lot of folks are convinced it’ll crash…

NOMI

That’s what I used to think… but this chart – and the market’s reaction to the Fed – has totally changed my thinking about a market crash.

You see, the mainstream press thinks the Federal Reserve is going to stop printing money to put a lid on inflation…

Once again, they’ve got it completely wrong…

In reality, the exact opposite is about to happen.

With all the turmoil in the markets right now, there’s absolutely no way the Federal Reserve is going to risk shutting off the spigot anytime soon.

According to my research, the Fed can’t raise rates enough to stop inflation… and they absolutely won’t stop printing.

CHRIS

So… in effect, the government is between a rock and a hard place…

NOMI

Exactly…

And that’s why we’re seeing all the bizarre things we’re seeing right now in our economy…

It’s all related.

As a result…

Thousands of Americans will soon become impoverished…

While others become much, much wealthier – practically overnight.

I used to think we could fix this mess…

I thought there might be a government solution to this picture.

But I’ve come to realize the gap is only getting wider.

That’s why it’s imperative you close the gap – personally, right now.

Crazy things are happening in the world…

So if you’re confused – I get it.

None of this is normal.

I recently saw a story about a 12 year old girl who has made almost $6 million on NFTs...

CHRIS

That’s more than most people will make in their entire lives!

NOMI

Yeah. At the same time, in cities across America, the folks in the middle class are struggling to keep a roof over their heads.

CHRIS

Two different extremes… two sides of the same coin.

NOMI

Exactly.

Many Americans don’t even know it yet… but they will soon be left behind…

It doesn’t matter if you’re making $50,000 a year… or $500,000… everyone is going to feel the pinch.

On his recent podcast, for example, billionaire Michael Saylor said:

Of course, most of us aren’t billionaires… and Michael Saylor will probably be just fine…

But now that you understand what’s happening…

There’s an upside to all the chaos.

I believe the opportunity to make huge gains – with just a few well-placed investments – has never been better than it is today.

Nobody in authority will tell you – certainly not the mainstream media...

But if you understand where this tidal wave of new money is flooding… you can position yourself to profit from this $150 trillion windfall…

And potentially multiply your wealth in the months ahead.

That’s why we’re here today.

CHRIS

Alright… sounds like we’re getting to the fun part. Because to be honest… I’m tired… and I think a lot of folks out there are sick of “waiting” for the world to make sense.

And we’re sick of watching the life we want slip away.

But I’m wondering – Nomi – where is all this money coming from? And what’s behind it all?

NOMI

OK – let’s get to it.

I know when we throw around a number like $150 trillion – it’s hard to fathom.

But I’m not exaggerating.

U.S. Treasury Secretary Janet Yellen alluded to this shift when she spoke to a group of powerful decision-makers recently. She said we’re about to see:

CHRIS

A ‘global transition’… so the US government is driving this distortion?

NOMI

The current administration is heavily involved, along with 136 other countries…

More than 90 banks are supporting the plan as well, including Bank of America –

And billionaires like Jeff Bezos and Elon Musk recently invested a portion of their own fortunes to get in front of this massive transition.

CHRIS

The government… big Wall Street banks… Jeff Bezos and Elon Musk… Nomi, I’m stunned.

What does this all mean to investors today?

NOMI

Great question, Chris.

In a minute, I’m going to show you my favorite way to make huge profits as the Great Distortion plays out.

But first, I’d like to show the viewers what happens when you’re able to connect the dots as a huge distortion unfolds…

When you think back to the Nixon Shock in 1971…

The value of the dollar plummeted and prices went haywire…

Folks who sat on the sidelines waiting for a return to normal were crushed by inflation…

But investors who bought hard assets like gold could’ve earned an incredible 2,300%.

And we saw a similar situation in 2008…

CHRIS

Ah… I remember… the government bailed out the banks…

NOMI

Right – to the tune of $7.7 trillion.

Again, folks who were in the wrong place got crushed as stocks collapsed and real estate values plummeted.

But those who were able to see through the carnage and spot the pattern could’ve pocketed huge.

Investors who took a stake in Apple in 2008, for example, and held on until today could’ve turned $1,000 into $32,500.

And we’re seeing a similar opportunity play out again right now…

Once again, many folks will be crushed…

While a handful will spot the pattern and prosper.

Chris, do you see what all these moments had in common?

CHRIS

Well it seems to me – at least on the surface – these were all responses to one crisis or another.

NOMI

Bingo…

We’ve seen one crisis after another.

And the response has always been the same.

More money printing. Which has driven the huge disconnect between the “real world” and “financial world” I showed you before.

CHRIS

Got it…

And all that money swirling around creates a massive distortion – in your words – which is harmful to most people… and helpful to others.

NOMI

You got it!

Wars… Pandemics… Deteriorating social conditions are all met with massive money printing.

But we haven’t seen anything yet!

In the months ahead, the Great Distortion is about to become a runaway train… We’re already seeing the early signs of change – everything from investing to technology, to art, transportation, and entertainment... even food is being disrupted.

But for most people…

The next stage of the complete transformation we’re about to see will be every bit as confusing as electricity when it first lit up cities across the American frontier…

As jarring as the automobile, replacing the horse and buggy against the wishes of millions in early America…

And even more revolutionary than radio, the TV, and the Internet, which have all transformed the way we communicate.

Ten years from now, we’ll look back and realize nearly every industry has been fundamentally reshaped. Distorted like nothing we’ve ever seen before.

The Great Distortion is the biggest transfer of wealth in history…

You can either use it to grow your wealth by leaps and bounds…

Or you can ignore it… hope for a ‘return to normal’ and risk missing out on this historic wealth-building opportunity.

The choice is yours.

If you make the right moves, you could set yourself up for the retirement of your dreams…

But for most Americans – those who choose to ignore my warning today… or, even worse, those who see it and fail to prepare…

Well, they may never be able to forgive themselves for missing out.

CHRIS

So what can our viewers do today to avoid missing out?

NOMI

Chris,

I’ve been following the money on Wall Street and in Washington, D.C for decades...

I’ve traveled tens of thousands of miles… from Berlin to Shanghai… from Sao Paulo to Tokyo to get the pulse of the global economy and what it means to ordinary people and their money.

I’ve met with government leaders and financial movers and shakers… all while writing six books on economics, history, the stock market, and Wall Street.”

And my seventh book, called Permanent Distortion: How the Financial Markets Abandoned the Real Economy Forever.

And I don’t want anyone to miss out. That’s why I’ve distilled the key points into a special report to show today’s viewers my favorite way to profit from this $150 trillion wealth transfer.

Inside, I’ll show you all the details of a small firm that could soar as it disrupts one of the world’s most critical industries.

As we’ve seen over the last few months, conflicts around the world and shortages at home have injected urgency into the plans for a New Energy reality.

We can no longer rely on foreign dictators and adversaries for America’s energy needs.

Most people don’t realize it yet.

Many are still living in the reality of the past…

But the energy industry – worth more than $2 trillion – is one of the biggest industries being transformed by America’s Great Distortion.

CHRIS

How so? I mean… what will these changes look like?

NOMI

They’re already happening… Look at what just happened at Exxon-Mobil for example.

Right. Chris, would you believe me if I told you the world’s biggest oil company just put three people on their board who despise oil…?

CHRIS

What?! That doesn’t make any sense…

NOMI

That’s the trap many will fall into. But you can avoid the trap if you understand this one fundamental thing…

This trend toward New Energy is inevitable. It will advance regardless of anything else that happens – whether we like it or not.

And it will ultimately turn out to be one of the biggest drivers of investment dollars in this $150 trillion transfer of wealth.

In my special report, called The #1 Stock for America’s Great Distortion, I’ll show you my favorite ‘‘New Energy’ stock, which is owned by just about every major institution on Wall Street…

Everyone from Citadel… to Vanguard and Morgan Stanley… can see what’s happening.

Wall Street has bought almost 60 million shares.

CHRIS

Nomi, Wall Street seems to be in love with this stock… is it too late to invest?

NOMI

Not at all. Remember, Chris, the ‘New Energy’ trend is one of the biggest trends in the world… and it’s early. We’re just getting started.

CHRIS

In your report – are you talking about a solar stock? Or wind energy?

NOMI

No, Chris… nothing like that at all. Those things are still years away from fully disrupting the existing system.

The company I’ve found is a cutting-edge tech stock inside of the energy sector…

Already, 76% of Fortune 50 companies are customers of this firm …

Its fast-growing portfolio of patents gives it a huge advantage over the competition… and its technology has won awards from Goldman Sachs, the World Economic Forum, CNBC, and more.

But here’s the most important detail for our viewers at home…

Congress recently earmarked billions of dollars for this firm’s cutting-edge technology.

CHRIS

Wow! So Nomi, how high do you think this stock will go?

NOMI

Well, the Motley Fool says it “could be a 10-bagger”…

And, over time, it could do even better than that…

But I’d say it could easily double or triple in the next few years.

CHRIS

In today’s markets – that would be fantastic.

How can someone like me – or the viewers at home – get their hands on a copy of your report?

NOMI

I’ve agreed to reserve the first edition of The #1 Stock for America’s Great Distortion: 10x Gains on a Small Firm Disrupting a Critical American Industry – and send it ONLY to folks who join my flagship investment newsletter, Distortion Report here today.

AND, in exchange for limiting the first run to folks who subscribe, the publisher of my Distortion Report newsletter has agreed to let me offer my work at a steep discount – exclusively available on this page – for folks who see this interview.

CHRIS

So this report – it won’t be available in bookstores, or Amazon…

NOMI

No, Chris. Never. The only place you can get this report is right here…

CHRIS

And you’ve negotiated a huge discount on behalf of today’s viewers… How can they get started?

NOMI

Well, before I explain the 75% discount and how to get started, I need to share an important word of caution with our viewers.

A lot of people who don’t understand what’s happening are about to get burned by this distortion.

But when you read my work… you’ll see the world in a completely different way going forward – a more accurate way.

You’ll instantly be able to cut through all the noise and spot the world’s biggest trends…

CHRIS

What do we need to look out for to figure out what’s ‘noise’ and what’s real?

NOMI

Good question… I’ll illustrate my point using infrastructure as an example.

CHRIS

Are you talking about basic roads… bridges… sewers… stuff like that?

NOMI

No… again, Chris… that’s the old paradigm.

Today, I’m talking about an entirely new kind of infrastructure spending – with far more upside for investors.

As we speak, Congress is spending billions on a massive new EV charging network…

For good reason. Without a robust, fast, and reliable charging network… electric vehicles are nothing but fancy lawn ornaments.

So forget roads and bridges – the typical, boring infrastructure investments you’ve heard about from the mainstream media…

That’s the kind of noise you need to learn to ignore.

I’ve found a firm focusing on a different kind of infrastructure… with substantially more upside for investors.

It’s not an electric car company or an electric vehicle charging company… but it holds the key that enables both to operate… and I’m definitely not talking about commodities like nickel or lithium…

CHRIS

It’s gotta be a semiconductor company then. Or a firm developing a cutting-edge battery?

NOMI

Chris… it sounds like you’re up to speed on the industry. Those are all great guesses, but let’s ‘zoom out’ and look at the big picture.

Millions of people are charging blindly into Electric Vehicle stocks, charging stocks, batteries, and commodities…

They’re seeing dollar signs – because the roll-out of electric vehicles seems inevitable.

But this could prove to be a very risky move.

I’ve found a firm almost everyone is missing when they consider investing in the electric vehicle industry…

But without the product this firm produces, the electric vehicle industry simply cannot exist.

Again, it doesn’t manufacture electric cars, batteries, chargers, or computer chips…

But electric cars – and many other modern conveniences would be impossible without its products.

That’s why I’ve put together another special report, called The Electric Car Myth: The Hidden Key to Unlocking 23x Profits in EV. This trend is so transformative and world-changing… it’s going to be with us the rest of our lives.

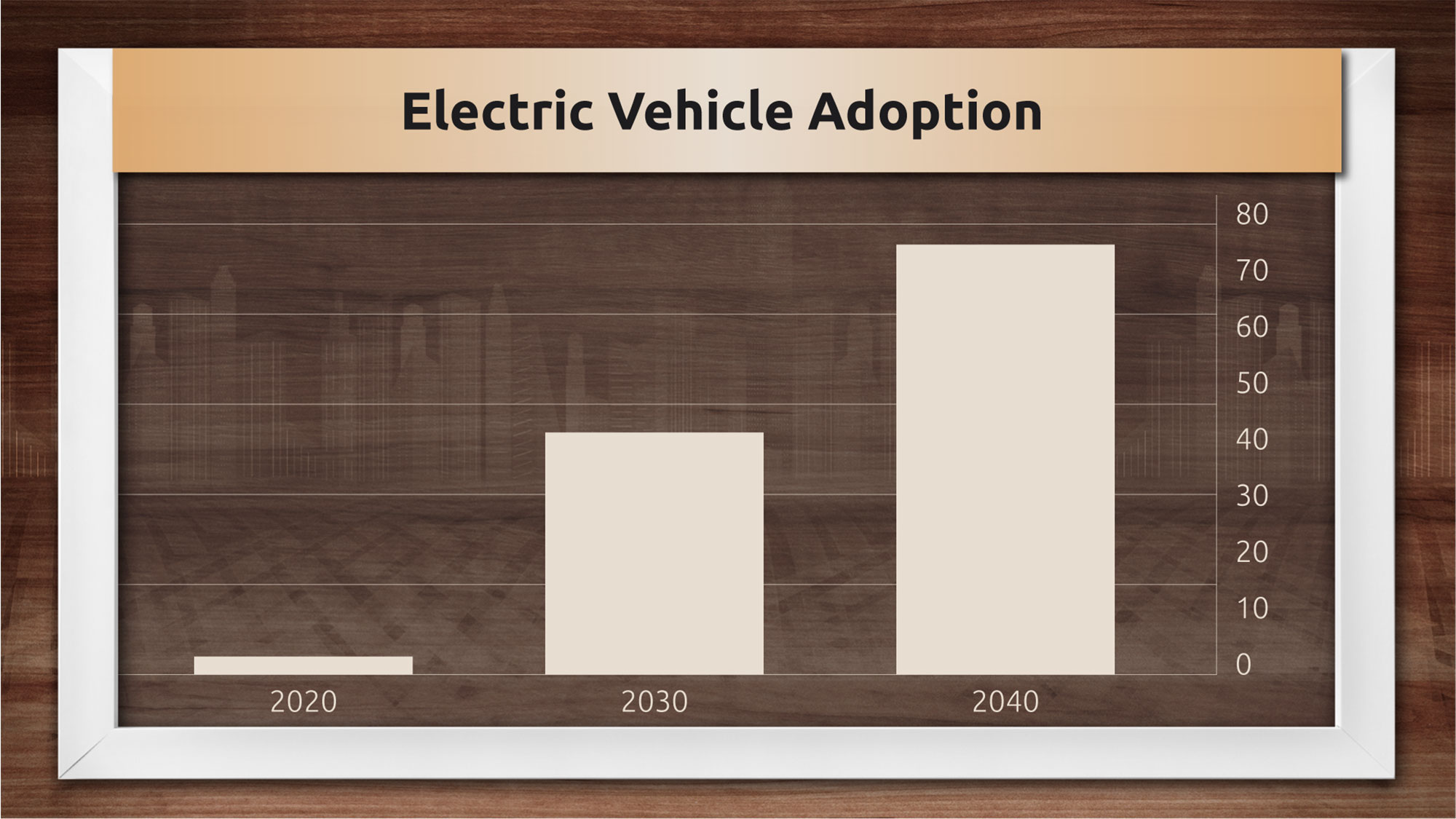

These charts are a perfect illustration of the growing demand for electric vehicles in the years ahead:

In my newest report, I detail a stock that holds the key to trillions of dollars in growth and innovation.

CHRIS

Nomi, how do the shortages and inflation we’re seeing around the world affect this stock?

NOMI

That’s a great question… while many Electric Car stocks will be hurt by inflation and shortages, this stock is virtually inflation-proof. AND, it could actually play a key role in solving many of today’s supply chain problems.

CHRIS

Incredible. And this report – will it be available in bookstores? Or is it also being offered only for today’s audience as well?

NOMI

The Electric Car Myth – along with The #1 Stock for America’s Great Distortion– is only available for today’s audience.

CHRIS

How can they get their hands on this report?

NOMI

It only takes a minute to get started, Chris.

I’ll explain how in a moment, but before we get to that, I’d like to show the audience one more huge trend I discovered from my network of Washington, D.C. insiders…

CHRIS

Yeah, a few minutes ago, you mentioned you’ve worked across the aisle to give economic advice… and you spoke with Senator Toomey’s office just a few weeks ago…

NOMI

I’ve met directly with prominent lawmakers… and I’ve even given testimony on the floor of the Senate…

I’ve also been invited to speak in a small, closed-door meeting with the world’s central bankers – including former Federal Reserve chair Janet Yellen…

CHRIS

Wow… it sounds like you’ve shared the stage with some of the world’s most powerful people…

NOMI

I have… and they don’t always like what I have to say.

But they always listen.

In fact, some of my contacts on Wall Street have called me directly to tell me they agree with my message – but they can’t say it out loud.

CHRIS

Of course – they can’t publicly agree with a lot of the things you say…

NOMI

Not publicly… it would cost them their jobs if they did. But many of them agree with my messages about the corruption on Wall Street.

And that’s why they still share important information that comes across their desk when they can.

CHRIS

Insider information?

NOMI

Oh no… nothing like that… everything they share is public, but it’s not easy to find. Unless you have connections to show you where to look.

And, right now, my connections are telling me about another huge opportunity for investors…

It is – without a doubt – one of the biggest opportunities we’ll see as the Great Distortion unfolds.

As we know, Chris, the events of the last two years have irreversibly changed the world.

The pandemic… the conflicts overseas… shortages and inflation…

The changes we’re seeing today usually take years… sometimes even decades to happen.

And now, things are getting harder and harder to recognize from one month to the next!

I‘ve already shown you how Big Energy and Transportation are being transformed…

We’re also about to see MASSIVE changes in the $23 trillion dollar world of big finance.

In the months ahead, Central Banks around the world are planning to go ‘digital.’

Many of the “legacy” banks you’ve heard of… where you probably even keep your money, like…

- Bank of America

- Chase

- Citi

- Wells Fargo

Are about to be ‘Reset’… overhauled by a new type of technology called FinTech. (Short for financial technology).

CHRIS

What exactly does that mean? For the banks – and for you and me?

NOMI

Essentially, it means the function of our banks is about to change.

They probably won’t raise public suspicion by changing the signs on your bank’s branches, but according to my sources, the Federal Reserve will soon ‘own’ all the banks… and your local branch will simply be a licensee of the Fed.

In other words, the banking infrastructure is being rebuilt from the ground up and very few Americans are aware it’s even happening.

We’re right on the verge of a once-in-a-generation opportunity to profit by investing in companies building out the architecture for this massive shift.

Put simply, “financial technology” is revolutionizing the $23 trillion dollar old-guard banking industry.

You see, over the past three years, while the total value of U.S. bank stocks has slid by 30%...

The total value of FinTech stocks has increased by 272%!

This chart shows the early stages of this huge distortion in action:

CHRIS

Why don’t we hear about this shift in the news? I mean this seems like it should be a front-page story if you ask me…

NOMI

I agree – but you have to remember, the central banks and the folks on Wall Street want to keep this transformation under wraps as long as they can…

CHRIS

So they can get in front of it first...

NOMI

Of course! And to avoid panic. This ‘reset’ will be a huge shock when Americans catch on. That’s why the average person won’t hear a word about this story until it’s obvious to just about everyone.

And by then, it’ll be too late.

CHRIS

The profits will be gone.

NOMI

The same way it works with any world-changing investment story.

That’s why, if you’re going to invest, I’d recommend you do it right now – today.

And I’ve found a small company at the center of it all…

They’re building the bridge between the legacy banking world and a new financial system.

That’s why I expect this company to become the leading firm powering the global payments system going forward.

CHRIS

That’s gotta be trillions of dollars!

NOMI

It was more than $5 trillion in 2020, and I’ve seen projections that it will be more than $11 trillion in the next few years.

This firm is exactly what I look for to recommend to readers of my Distortion Report newsletter. It’s as close to perfect as it gets… its financials are terrific, its management team is world-class, and it’s developing an asset that could become a global standard in the next 12 months.

Our viewers today can get all the details in my special report Bank to the Future: The Firm Transforming the $11 Trillion Financial Industry

CHRIS

Between The #1 Stock for America’s Great Distortion, The Electric Car Myth, and Bank to the Future… I don’t know which one to read first...

Here's how to get started

NOMI

Chris, you read my mind.

That’s the number one thing I recommend right now –

At this critical moment in history, it’s important to take action.

As I showed you today…

A handful of historic events, starting in 1971 – the Nixon Shock, the Great Recession, and the global emergencies we’ve seen over the past two years – have distorted the American economy to the point of no return.

The cost of living is spiraling out of control, and a new, historic shift is upon us.

Store shelves are bare with no end in sight…

And even folks who have done everything ‘right’ are finding it impossible to get ahead.

The popular stocks of the past few years are crumbling…

While a few key sectors in our economy soar to record highs that would’ve been unfathomable even six months ago.

If you take a position in the right investments today, there’s a chance you’ll walk away with more wealth than you’ve ever thought possible.

But if you get into the wrong ones – or if you stay on the sidelines, afraid of the next huge shock…

That’s why I wanted to make it as simple for you as possible to position yourself on the right side of this distortion.

As I mentioned a few minutes ago, my publisher has agreed to let me share all of my most critical research with today’s viewers at a steep discount.

The normal price for Distortion Report is $199...

But today, my publisher has authorized a one-time 75% discount, so you’ll pay just $49.

And, if you sign up right now, I’ll send you – immediately and by email – the reports I’ve shown you here today:

- The #1 Stock for America’s Great Distortion: 10x Gains on a Small Firm Disrupting a Critical American Industry

- The Electric Car Myth: The Hidden Key to Unlocking 23x Profits in EV

- Bank to the Future: The Firm Transforming the $11 Trillion Financial Industry

… each yours when you try out my flagship investment newsletter, Distortion Report, for just $49.

CHRIS

Nomi, can today’s viewers see the reports before they buy?

NOMI

No, my publisher wouldn’t let me do that… But here’s what I CAN do…

If, within the first 60 days, viewers decide – for any reason at all – my reports fall short of expectations… or if Distortion Report is simply not right for them, that’s perfectly OK.

They can simply call my friendly, Florida-based customer service team and let them know, and we’ll send a refund for every penny.

CHRIS

Nomi, that’s great. There’s absolutely no risk to look over all of your work!

NOMI

None whatsoever. It’s how I’d want to be treated if I were in their shoes.

Now, I’d like to leave everyone with a final thought.

The central banks have printed trillions upon trillions of dollars.

Ordinary folks across America are waiting, hoping for a return to normal…

Those who don’t understand what’s happening are finding it harder and harder to get ahead…

And many will never recover.

I have no doubt the Great Distortion is an event we’ll still be talking about 50 years from today.

If you take the right steps immediately, you’ll have the opportunity to multiply your nest egg with a few simple, strategic moves.

You’ll find out how you can set yourself up to create generational wealth for many years to come.

Please click the button below to get started now.

CHRIS

Nomi, before we started today, I’m not sure I really understood why America’s economy has felt ‘off’ for the better part of the past decade.

But now, I know exactly why – and more importantly, what I can do to prepare.

Thank you for being with us today.

NOMI

Chris, thanks for having me.

And to everyone at home, thanks for watching the following video.

IS THIS WHAT IS HAPPENING?

The Shemitah & The Seven Year Cycle Of Economic Crashes That Everyone Is Talking About

by Freedom Outpost October 17, 2015, in News

The Shemitah & The Seven Year Cycle Of Economic Crashes That Everyone Is Talking About

Large numbers of people believe that an economic crash is coming next year based on a seven-year cycle of economic crashes that goes all the way back to the Great Depression. What I am about to share with you is very controversial. Some of you will love it, and some of you will think that it is utter rubbish. I will just present this information and let you decide for yourself what you want to think about it.

In my previous article entitled “If Economic Cycle Theorists Are Correct, 2015 To 2020 Will Be Pure Hell For The United States”, I discussed many of the economic cycle theories that all seem to agree that we are on the verge of a major economic downturn in this country. But there is an economic cycle that I did not mention in that article that a lot of people are talking about right now. And if this cycle holds up once again in 2015, it will be really bad news for the U.S. economy.

Looking back, the most recent financial crisis that we experienced was back in 2008. Lehman Brothers collapsed, the stock market crashed and we were plunged into the worst recession that we have experienced as a nation since the Great Depression. You can see what happened to the Dow Jones Industrial Average on the chart that I have posted below…

Prior to that, the last time that the stock market experienced a major decline of that nature was during the bursting of the dotcom bubble seven years earlier. 2001 was a year of recession for the U.S. economy and of big trouble for stocks.

And oh year, a little event known as “9/11” happened that year.

Seven years before that, in 1994, investors experienced the worst bond market of their lifetimes.

The following is how Reuters recalls the carnage…

The 1994 bond market massacre is remembered with horror by those who lived through it. Yields on 30-year Treasuries jumped some 200 basis points in the first nine months of the year, hammering investors and financial firms, not to mention thrusting Mexico into crisis and bankrupting Orange County.

Going back another seven years brings us to 1987.

Anyone that lived through that era remembers “Black Monday” and the horrible stock market crash very well.

The next major economic crash prior to 1987 was in the early 1980s.

In 1980, the S&L crisis was blooming and everyone was talking about the “stagflation” that we were experiencing under Jimmy Carter. The Federal Reserve raised interest rates dramatically to combat inflation, and this helped precipitate the very deep recession that we experienced early in Ronald Reagan’s first term.

You can read much more about the “early 1980s recession” right here.

Seven years prior to 1980 brings us to 1973. To many young Americans, that year does not have any significance, but older Americans remember the Arab oil embargo and the super long lines at the gas pumps really well.

In addition, a recession began in 1973 which ended up stretching all the way until 1975.

And those that have studied these things say that the pattern keeps going back all the way to the Great Depression. Many correctly point out that the stock market crash which began the Great Depression was in 1929, but actually, the worst year for the stock market during the Great Depression was in 1931. And 1931 fits perfectly into the cycle.

So we have this pattern of economic crashes occurring approximately every seven years.

But there is an additional element to this cycle that makes it even more extraordinary.

As Jonathan Cahn has pointed out, this seven-year cycle also lines up with the seven-year “Shemitah cycle” that we find in the Bible.

For those not familiar with it, during the Shemitah year, the people of Israel were commanded to let their land rest for a full year. It was also supposed to be a time of releasing debts.

But for the most part, the people of Israel did not observe the Shemitah year, and in the Bible that is mentioned as one of the reasons why they were exiled to Babylon for seventy years.

The Shemitah year always begins in the fall, and the upcoming Shemitah year is going to start about a month from now.

Will we see things happen during this Shemitah year that is similar to things that we have seen in past Shemitah years?

For example, on September 17th, 2001 we witnessed the greatest one-day stock market crash in U.S. history up until that time. It happened on the 29th of Elul on the Jewish calendar, which is the day right before Rosh Hashanah.

That record stood for seven years until the massive stock market crash of September 29, 2008. That date also corresponded with the 29th of Elul on the Jewish Calendar – the day right before Rosh Hashanah.

Will the pattern hold up in 2015?

Well, the 29th of Elul falls on a Sunday in 2015, so the stock market will be closed. But it is very interesting to note that there will be a solar eclipse on that day.

And as Jonathan Cahn recently told WND, similar solar eclipses in the past have preceded major financial disasters…

In 1931, a solar eclipse took place on Sept. 12 – the end of a “Shemitah” year. Eight days later, England abandoned the gold standard, setting off market crashes and bank failures around the world. It also ushered in the greatest month long stock market percentage crash in Wall Street history.

In 1987, a solar eclipse took place Sept. 23 – again the end of a “Shemitah” year. Less than 30 days later came “Black Monday” the greatest percentage crash in Wall Street history.

Is Cahn predicting doom and gloom on Sept. 13, 2015? He’s careful to avoid a prediction, saying, “In the past, this ushered in the worst collapses in Wall Street history. What will it bring this time? Again, as before, the phenomenon does not have to manifest at the next convergence. But, at the same time, and again, it is wise to take note.”

So what should we make of all of this?

I am sure that some of you will dismiss this as pure coincidence and speculation.

Others will find it utterly fascinating.

But one thing is for sure – people are going to be talking about this seven-year cycle all over the Internet.

When they ask you what you think, what are you going to say?