CBDC SOCIAL ENGINEERING

By Charles Steele, chair of the department of economics, business, and accounting at Hillsdale College in Michigan - 27 Nov 2022

In Steele’s view, the FTX fiasco is likely to speed up the crafting and implementation of central bank digital currencies (CBDC). Steele noted that the Federal Reserve Bank of Boston is collaborating with the Massachusetts Institute of Technology on a joint study, Project Hamilton, whose objective is to devise a CBDC for the United States.

While ignored by many people, this is one of the most potentially concerning recent developments given the unprecedented powers that it stands to place in the hands of a central regulatory authority, he said. While some might initially welcome a CBDC, it could have unforeseen consequences and ultimately could help extend the role of government into people’s lives in ways to which they are so far unaccustomed.

“I think a CBDC is very dangerous because it would enable a central bank or government to monitor, control, and record every exchange made with the currency.

If, for example, a government decided it did not want citizens buying, say, firearms, or perhaps donating funds to a political candidate, the central bank could prevent the transaction. Alternatively, it could have a permanent record of a citizen’s purchases and use these to establish a social credit score for the person,” Steele said.

“In this way, a CBDC could become the ultimate tool of social engineering and tyranny. A true cryptocurrency keeps transactions anonymous, which is one of its great benefits. Governments tend to dislike tools that give citizens such privacy,” he added.

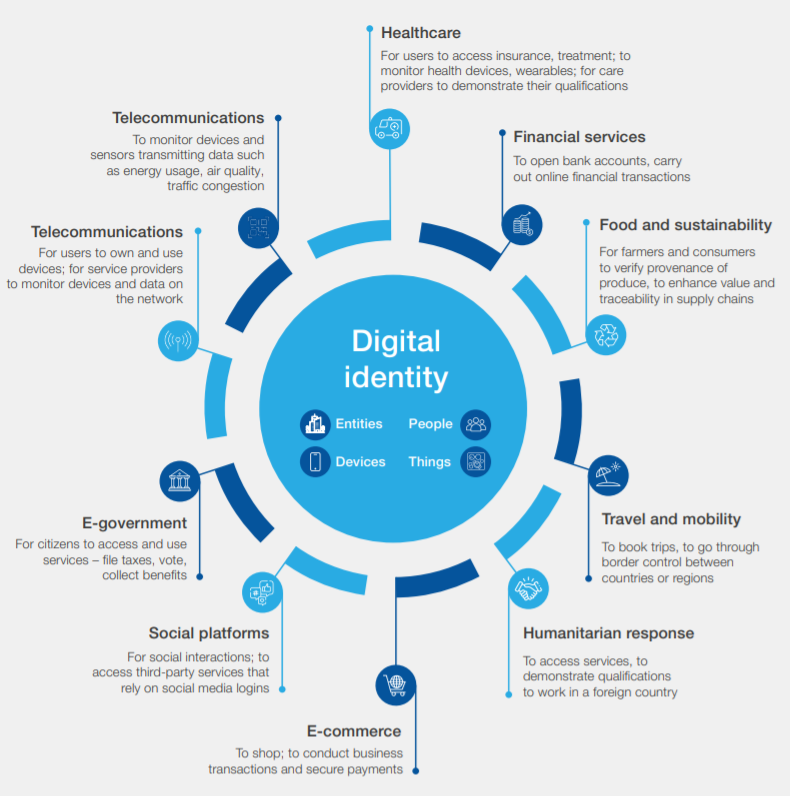

US, and EU tiptoe towards digital ID, central bankers confirm CBDC would not be anonymous.

CBDC linked with digital ID would allow governments & corporations to put permissions on what you can buy with your own money: perspective.

The heads of both the American Federal Reserve and the European Central Bank confirm Central Bank Digital Currencies (CBDC) would not be anonymous, which paves yet another path for all-encompassing digital identity schemes.

On September 27, France’s central bank — the Banque de France — held an international roundtable in which central bankers from the US and the EU confirmed that digital dollars and euros, should they go forward, would not be anonymous.

In other words, these Central Bank Digital Currencies (CBDC) would require some form of digital identity scheme.

CDBC also run the risk of having every transaction recorded while being fully programmable, which means central banks and/or their customers could have total control over where, when, and how their money is spent.

“It [CBDC] would not be anonymous. It would not be an anonymous bearer instrument” — Jerome Powell, Federal Reserve, 2022

During the international roundtable, Federal Reserve Chair Jerome Powell said that with respect to an American CBDC rollout:

“If we were to pursue a CBDC, it would at the minimum have the following four characteristics:

“First is intermediated. The second is privacy protection.

“The third is identity verified, so it would not be anonymous. It would not be an anonymous bearer instrument.

“And fourth is transferable or interoperable.

“So, we would be looking to balance privacy protection with identity verification, which has to be done of course in today’s traditional banking system as well.”

“This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us” — World Economic Forum

A digital dollar doesn’t have to be a Central Bank Digital Currency; anonymity is a bedrock of freedom: Congressional hearing

‘If the digital dollar is to stand for more than surveillance, data mining & political censorship, US policymakers must be willing to articulate & defend a different set of principles’: Rohan Grey

A digital fiat currency expert testifies that it’s a mistake for Congress to only consider Central Bank Digital Currencies (CBDC) when exploring digital dollars, adding that transactional anonymity is a bedrock of freedom in a democratic society.

“It is a mistake to equate and reduce the wide spectrum of digital fiat currency architectures […] to the more limited category of CBDC, which refers only to those models in which central banks are the exclusive issuers and administrators” — Rohan Grey

Today, the US House Committee on Financial Services Task Force on Financial Technology held a hearing exploring the “Technological Infrastructure, Privacy, and Financial Inclusion Implications of Central Bank Digital Currencies.”

Expert witness Rohan Grey warned that a United States CBDC could be used for surveillance and censorship and that it would be a mistake for Congress to ignore historical precedents when considering a digital dollar.

“If the digital dollar is to stand for more than surveillance, data mining, and political censorship, American policymakers must be willing to articulate and defend a different set of principles and commitments” — Rohan Grey

Grey told the congressional task force that it was limiting the full scope and potential of digital fiat currency systems by only looking at Central Bank Digital Currencies.

“Contrary to popular misconception, the Federal Reserve is not, and has never been, the only entity responsible for issuing currency or providing public payment services,” said Grey.

“Throughout American history, the [US] Mint, the Bureau of Engraving and Printing, the Bureau of the Fiscal Service, and the US Postal Service have all designed, issued, and operated various forms of public monetary technologies.

“It is thus a mistake to equate and reduce the wide spectrum of digital fiat currency architectures and arrangements to the more limited category of Central Bank Digital Currency, which refers only to those models in which central banks are the exclusive issuers and administrators,” he added.

“If we do not take active and committed steps to reverse our decline into information and surveillance capitalism, […] we will end up in a world in which token-money, and the freedoms and civil liberties that it affords, are functionally extinct” — Rohan Grey

Grey, who carries with him a host of titles including Assistant Professor of Law at Willamette University, Director of the Digital Fiat Currency Institute, and Consultant to the UN International Telecommunications Union’s Focus Group on Digital Currency, warned Congress about going down the path of surveillance, censorship, and control.

In his written testimony, Grey elaborated on the potential for political censorship and oppositional persecution, which occurs whenever public and private entities attempt to self-regulate.

“History reminds us time and time again that public actors […] cannot always be relied upon to self-regulate the worst excesses of their often well-intentioned desire to compromise individual rights and due process in the pursuit of swift and efficient administration of justice”

“It is often asserted that as long as there are adequate privacy safeguards baked into centrally administered systems, then there is little to worry about when it comes to the potential for abuse,” he wrote.

“I would strongly urge members of this Task Force not to indulge in this dangerous fiction, which is typically paired with the personal sentiment that ‘as long as one is not doing anything wrong, one should have nothing to hide.’

“History reminds us time and time again that public actors, even those we tend to consider on the side of right and good, cannot always be relied upon to respect their own bright lines, or to self-regulate the worst excesses of their often well-intentioned desire to compromise individual rights and due process in the pursuit of swift and efficient administration of justice,” he added.

In both his written and spoken testimony, Grey asserted that a digital dollar should be complementary to physical, hard currency and that the safest approach to data protection, privacy, and freedom should be one that mimics the Hippocratic Oath: “first, do no harm.”

“There are meaningful and important differences between a digital fiat currency regime committed to preserving the privacy and freedom-respecting features of physical currency, and one built exclusively instead around common ledger or account-based technologies in which all transactions are recorded and censorable by design,” he testified.

“The safest and most defensible approach is to adopt a Hippocratic-style principle of ‘first, do no harm.’ In the context of digital financial privacy, the best way to limit the risk of data abuses is to not collect it in the first place.”

“In the context of digital financial privacy, the best way to limit the risk of data abuses is to not collect it in the first place” — Rohan Grey

Earlier this year, the People’s Bank of China began rolling out its own digital currency that would allow the Chinese Communist Party to further surveil, coerce, and control its citizens’ behavior as part of its larger social credit system.

During Tuesday’s hearing, Grey advised, “If the digital dollar is to stand for more than surveillance, data mining, and political censorship like China’s digital yuan or Facebook’s Diem [formally known as ‘Libra’], American policymakers must be willing to articulate and defend a different set of principles and commitments, even when doing so entails difficult choices.”

“It is not difficult to envisage a future in which political donations, even within the United States, become increasingly subject to censorship and monitoring by those in control over the technological means of payment” — Rohan Grey

Should a digital dollar be abused by political interests, Grey warned, “It is not difficult to envisage a future in which political donations, even within the United States, become increasingly subject to censorship and monitoring by those in control over the technological means of payment.”

Furthermore, he added, “If we do not take action and committed steps to reverse our decline into information and surveillance capitalism, […] we will end up in a world in which token-money, and the freedoms and civil liberties that it affords, are functionally extinct.”

“Transactional anonymity, like anonymity more broadly, is a public good and a core bedrock of political freedom in a democratic society” — Rohan Grey

According to Grey, anonymous peer-to-peer financial transactions are a bedrock of political freedom in a democratic society, and he urged Congress not to fall for the “seductive narrative” that anonymity is what allows criminal enterprises to thrive.

“It is now common to hear claims today that if we allow anonymity in digital currency networks, we are effectively giving a green light to criminals, money launderers, and terrorists,” he testified.

“I strongly urge members of this Task Force not to be enticed by this crude, albeit seductive, narrative.”

Grey recommended that lawmakers treat digital fiat currency platforms like common utilities available to all citizens as a public good while expanding the notion of “net neutrality” to the concept of “currency neutrality.”

“Congress should adopt a principle of currency neutrality similar to net neutrality whereby digital fiat currency platforms and technologies are treated as common utilities available to all as a public good” — Rohan Grey

“It is not uncommon to hear policymakers claim that designing a digital dollar system to allow for anonymous, peer-to-peer transactions would be radical or extreme,” Grey told Congress, adding, “I profoundly disagree.”

“Transactional anonymity, like anonymity more broadly, is a public good and a core bedrock of political freedom in a democratic society.”

The expert witness went on to recommend:

“Above all, Congress should adopt a principle of currency neutrality similar to net neutrality whereby digital fiat currency platforms and technologies are treated as common utilities available to all as a public good.”

WE CAN NOT LET THE GOAT WATCH THE HAY!

Access to personal data in a crypto-based money system must be constantly guarded by AI supervised by a group of dual interest guardians, re-elected every 4 years. Access to information on criminal transactions can be given to the appropriate authorities upon application to the supervisory group.