DEFCON 2... Or Cutting Off The Nose To Spite The Face

ZeroHedge - BY TYLER DURDEN - TUESDAY, JUN 21, 2022 - 08:20

By Peter Tchir of Academy Securities

I had difficulty choosing a title for today. DEFCON 2 made a lot of sense as I’m increasingly worried about the economy and the market – for this summer.

On the one hand, I’m so perplexed by the messaging that the Fed is prepared to trigger a recession in its fight with inflation that I can’t help but think about cutting off your nose to spite the face. I could almost see Powell starting the press conference with “this is going to hurt me more than it is going to hurt you,” which based on my experience, is rarely true.

Inflation - Food

To expect monetary policy to reduce food prices seems like a stretch. We all must consume some basic level of food regardless of our income level. Sure, maybe the rich eat more Kraft dinners with fancy ketchup [apologies to the Barenaked Ladies], but food consumption seems relatively inelastic.

Maybe lowering the cost of fuel will help reduce the cost of food [shipping, the farmer's use of diesel, etc.], but I'm not sure that will happen quickly enough [or be impactful enough] to help the average consumer in the meantime. Many of those consumers are now facing higher costs of funding - anything from credit cards to ARMs, or any new loan that they are looking at.

The supply chain disruption is primarily wheat [and other basic groins due to the Russian invasion of Ukraine] is real and is likely to lose into next year. The longer that lasts, the more stockpiles will be eroded. That is a problem not impacted much one way or the other by interest rates.

The shortage of fertilizer [a topic of conversation] will admittedly be helped by reduced energy prices [if the Fed achieves that], but again, I'm not sure this provides much near-term relief,

Food, which may or may not is accurately reflected in official inflation measures [when I write may or may not I mean definitely not, but don't want to sound too aggressive] is unlikely to see price declines to the point where the consumer is helped materially. While the official data may or may not be accurate, the consumers know the "real world'' costs and that is affecting their behavior, their sentiment, their outlook, and ultimately their spending,

I remain extremely worried about food inflation.

Inflation - Energy

I'm not sure that even the "after school" specials that used to air on broadcast TV [that always had a morality message] could come up with a plot where the "hero" beats up on the "villain" for most of the show, only to realize that the "villain" has something they need, Then the "hero" reaches out to the "villain" to strike a "mutually" beneficial deal and the "villain," which is so overjoyed to become part of the "good team," immediately acquiesces to that and ignores all the previous messaging,

Weirdly, it is a plot too unbelievable for a children's special, but one that "we" (collectively] seem to think will work with Iron, Venezuela, and the Saudis. I won't even touch on the "side plot" of the long-overlooked friend, eagerly waiting for o word of encouragement from the "hero" and ready to step up and deliver, finding itself being treated worse than the "villain" at a time of need.

If you missed the Academy Podcast that was "dropped" (I think that's the cool term for it] on Friday, I highly recommend listening to it, General Kearney [ret,] leads the conversation, along with Rachel Washburn, Michael Rodriguez [from an ESG perspective], and me, on nuclear proliferation, the nuclear geopolitical landscape, and also, crucially important, thoughts on the future of nuclear energy,

But I've digressed, as those energy issues are really more issues related to D.C. and policy rather than anything controlled by interest rates and Fed policy,

But maybe after all I didn't digress that much because I don't see how Fed policy helps reduce energy prices, other than if they are "successful” in derailing the economy.

Again, much like food, individuals can only tinker with their need for energy. All of this has a limited impact on overall consumption: keeping the house warmer in the summer, colder in the carpooling winter, carpooling a bit more, being more organized on errands, convincing the bosses that WFH is good for the environment, etc.

Higher energy costs are already causing the demand shrinkage from consumers and I don't see any direct way that higher rates will help reduce gas demand or prices, unless, again, the Fed is "successful" in making the economy worse by a significant margin.

On the other side of the coin, higher interest rates seem likely to increase the cost of new production and storage. Any company tying up working capital or expanding production is now experiencing higher interest costs and logic dictates that they will try and pass some of those costs on or not embark on some projects due to the higher cost of funds,

So, the rate hikes’ direct impact on energy prices is to probably push them higher as the production and distribution systems face higher costs.

Reducing Energy Prices, aka, Hitting the Economy Hard

If interest rates are going to reduce energy prices it is going to come from cratering demand for anything and everything that uses energy that can be affected by interest rates!

Housing/Real Estate/Construction. I have no idea how much energy goes into building a new home, but I assume a non-trivial amount, The materials that go into constructing a building can be energy-intensive [copper piping, etc,], and The transportation of these materials to the building site is also expensive, We are already seeing negative data in the housing sector [new home permits are down, expectations for new home sales are declining, the Fannie Mae Home Purchase Sentiment Index is at its lowest level in a decade [except very briefly in March 2020 during the Covid lockdowns], I'm sure I could find more data pointing to housing slowing, but maybe highlighting that the Bankrate.com 5/1 ARM national average is at 4.1% versus 2.75% at the start of the year, is sufficient, We could look at 30-year mortgages and really shock you, but I think that the 5/1 is as interesting as the rate environment because it demonstrates that there is little relief anywhere along the curve for those needing new mortgages.

Autos. Annualized total U.S, auto sales [published by WARD'S automotive] have fallen recently. This measure has been "choppy" to say the least as auto sales have clearly been hit by supply issues. For many makes and models, I'm hearing the wait time is 6 months for a car where you pick the features and it is built to your specifications [which had become the "normal" way of buying cars]. So, maybe, just maybe, the sales here are still being impacted by that, but I’d have to guess that rising auto loan costs are playing a role as well. The Manheim used vehicle value index is still very high but has stabilized of late. If that stabilization is related to higher loan costs, then it is bad for the auto industry. If it is related to new cars and trucks being more readily available, it isn't a great sign, since that means the new auto sales indications cannot be entirely explained away by supply constraints. My understanding, given the steel and other components, is a lot of energy goes into producing a new automobile. So, I guess it is "good" news that slowing auto sales [and presumably production] will curb energy demand?

Consumer Purchases and Delivery, Everywhere you turn there are stories and anecdotes about consumer purchasing slowing down, CONsumer CONfidence [as discussed last weekend] is atrocious! Not only does the energy go into the production of the goods that the consumer was purchasing, but with home delivery being such a feature of today's purchasing behavior, energy consumption should go down as delivery services slow down [and as they continue to become more efficient - a process spurred on by higher gas prices].

I’m not sure whether to laugh or cry.

Higher interest rates will "help" reduce demand for autos, housing, and general consumer consumption, Apparently, that is good, because it reduces demand for energy and energy inflation [as well as inflation for those products]. I can see that, but I cannot help but think that we need to Be Careful about What You Wish For!

A Special Place in Hell for Inventories

I fear that inventories were a big part of the rise in inflation and would contribute to stabilizing prices [all else being equal] and that recent rate hikes are going to turn a "normal" normalization into something far more dangerous,

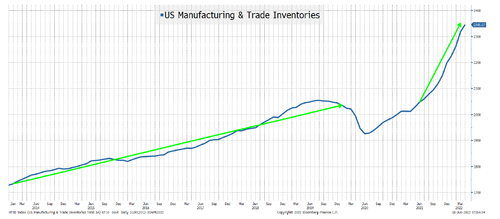

Manufacturing and Trade Inventories grew from 2014 until COVID at a steady pace, This seemed to correlate nicely with the growing U.S. and global economy. They dropped with supply chain issues but we're back to pre-COVID levels by last summer. Then, from late last summer until the end of April [the most recent data point for this series], these inventories grew rapidly!

- Companies worried about supply chain issues overstocked. This could lead to much lower future orders.

- Companies shifting to "just in case" from "just in time" need higher inventories, so that part would be stable, but costs of carrying inventory have increased,

- Maybe companies used straight-line extrapolation to accumulate inventory to meet expected consumer demand. That is bad for inventories if the demand isn't materializing! It is extra bad if consumers pulled forward demand in response to their supply chain concerns, meaning that any simplistic estimate of future demand [always problematic, though easy] is even further off the mark as the extrapolation was based on a faulty premise [which is not thinking consumers responded to supply chain issues].

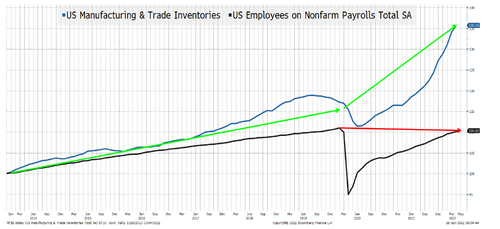

We may have an inventory overhang in the economy. While inventories are significantly higher than pre-COVID levels, the number of people working has still not returned to pre-COVID levels, Yeah, I get that it is far easier to "spend now, pay later" than it used to be through a variety of fintech solutions [ignoring rising interest costs] and that the "wealth effect" and "gambling" culture allows for more spending per job [or maybe it did a few months ago, but not now?] Maybe I'm just a stick in the mud, but...

When I look at this chart, I see the correlation between a total number of people working and inventory has been completely dislocated! [It also makes me question some of the supply chain issues we allegedly have].

Again, this potential inventory overhang is "amazing" if you want to slow orders and "fix" inflation by having to work off excess inventory rather than adding more.

Apologies, if you're tired of reading my snarky comments about things being "good" for inflation-fighting. I'm tired of writing them but cannot think of what else to do.

But the Economy is So Resilient?

The "Disruptive Portfolio" Wealth Destruction

We have examined the concept of Disruptive Portfolio Construction and continue to think that this is playing a major role in how markets are trading, but increasingly this creates a potential shock to the economy,

Let's start with crypto,

Bitcoin briefly dropped below $19,000 Saturday morning. I have no idea where it will be by the time you are reading this, but I am targeting $10,000 or less for bitcoin within a month or so.

First, the "altcoins" [some of which are derisively referred to as "sh*t-coins"] are a complete mess.

Solana is down 88% from its November 2021 highs and is roughly back to where it "debuted" in June 2012. Dogecoin, which I think was originally created as a joke, but rose to 70 cents [I think the weekend of Elon Musk's Saturday Night Live appearance] is back to 5 cents, which I guess is still good for something that was originally created as a joke.

Ethereum, a "smart contract" that has some use cases very different than bitcoin and was often talked about as a superior product, is down 80% from its November 2021 highs.

Under the Bloomberg CRYP page, there are 25 things listed as "Crypto-Assets". Maybe if I looked at each one I'd find some with a different story, but somehow, I doubt it. Okay, I lied, I couldn't resist, I had never heard of Polkadot, but it looks like it was launched in April 2021 at $40, declined to $11, rallied to $54 in November 2021, and is now down to $7 [at least the name is still cute].

But bitcoin is the story I’m looking at because it is the biggest and the one that seems to have the most direct ties to the broader market.

Crypto, to me, is often about adoption. It was why I got bullish a couple of years ago and caught at least part of the wave. Back then, every day some new, easier, better way to own crypto was being announced. Companies and famous billionaires were putting it on their corporate balance sheets. FOMO was everywhere with people racing to put ever higher targets on its future price and those who didn't have anyone to jump on to the bandwagon with were hiring people who could put on an ever-higher price target with a straight face.

That ended a while ago and we are in the "disadoption" phase [spellcheck says disadoption isn't a word, but I'm sticking with it].

Or as I wrote the other day, which the FT picked up on, we have moved from FOMO [Fear Of Missing Out] to FOHO [Fear of Holding On]. Even more concerning is a world where HODLING [originally either a mistype of HOLDING that gained traction or short for Holding On for Dear Life] is more prevalent and many people are now unable to exit their positions even if they wanted to.

There are some serious "plumbing" issues right now in the crypto space. Maybe the decentralized nature of crypto will work and be extremely resilient [I cannot fully discount that possibility] but maybe, just maybe, there is a reason banks and exchanges have regulators who enforce rules to protect everyone [yes, I can already see the flame mail accusing me of FUD and not understanding how self-regulating is better, etc, but then all I do is spend about 10 minutes looking at some of the shills out there and fall back to thinking "adult supervision" might be wise].

- Stablecoins. Stablecoins are what I would call a "thunk" layer in a programming language, It is an intermediate layer between two things, in this case, cryptocurrencies and fiat, Terra/LUNA got wiped out, but it was an "algo" based stable coin which many, in hindsight, say was a flawed design [clearly it was], but that didn't stop it from growing to $20 billion with some big-name investors engaged. Tether is the one garnering a lot of attention now. It is still the largest stable coin and it did survive an "attack" of sorts after the Terra/LUNA fiasco. The issue with Tether is that it purports to be fully backed by "safe" assets, yet will not produce audited financials. The disarray in stable coins should at the very least slow adoption.

- Freezing Accounts. Celsius blocked withdrawals 5 days ago and as of the time I'm typing this, it was still frozen. Babel Finance announced Friday that it would stop withdrawals. I found this one particularly interesting, as in May, according to news reports, it raised $80 million in a Series B financing, valuing it at $2 billion. Maybe needing to suspend withdrawals isn't a big issue, or maybe it is a sign of how rapidly things can change in the space?

- Right now, I’d be more worried about extracting value from the system rather than adding to the system. Yes, these are isolated cases [so far] and there are some big players in the space which presumably are not at risk of such an event, but having lived through WorldCom and Enron, and then the mortgage fiasco of 2008, I'm heavily skewed to believing that the piping issues will spread and get worse before they get better.

- Industry Layoffs. In a rapidly evolving industry, one with so much potential, it makes me nervous how quickly we are seeing layoffs announced publicly or finding out about them privately. Maybe I'm cynical, but to me, that signals that the insiders aren't seeing adoption increase, which for anything as momentum dependent as crypto has been, seems like a signal for more pain.

The big question is how many of the "whales" and big "hodlers" will buy here to stabilize their existing holdings or whether some level of risk management is deemed prudent. You cannot go more than two minutes talking to a true believer without "generational wealth" being mentioned [trust me, I've tried]. At what point does wanting to stay really rich become the goal rather than trying for generational wealth, even if it means converting back ("cringe") to something as miserable as fiat?

I expect more wealth destruction in crypto and that will hurt the economy!

- The wealth itself is gone, curbing spending [I'm already noticing how much I miss the Lambo photos all over social media].

- The jobs are now disappearing, curbing spending.

- The advertising will likely slow down [though not having to watch Matt Damon or LeBron wax on about crypto might be a good thing for our sanity]. But seriously, ad dollars from this lucrative source [I'm assuming it's lucrative given how often ads appear in my social stream, during major sporting events, and even in an arena [or two] could be drying up just as retailers are also struggling. It seems that every week there is a conference somewhere dedicated to crypto [with Miami and Austin seemingly becoming a non-stop crypto conference/party]. This could turn out to hurt many companies and even some cities,

- Semiconductor purchases could decline. Mining rigs have been a big user of semiconductors, All you have to do is pull up a chart of bitcoin versus some select semi-conductor manufacturers and the correlation is obvious, Energy usage could decline. If mining slows [as a function of lower prices and less activity] then we might see less energy used by the crypto mining industry [the public miners are in some cases down almost 90% from their November 2021 highs, presumably because the industry is less profitable]. Ultimately this could reduce energy prices and semiconductor prices/backlogs, which would generally be good for the broader economy and would help the Fed on their inflation fight, but could hurt some individual firms that rely on this industry.

My outlook for crypto is that we have more downside in sight and that will hurt broader markets and might do far more damage to the economy than many of the crypto haters realize. It is fine to dislike crypto, but it is naïve not to realize how much wealth was there helping to spend and how impactful a slowdown in this industry could be!

This brings me briefly to "disruptive" stocks. The wealth created by these companies was simply astounding, Whether remaining in the hands of private equity or coming public through IPOs or via a SPAC, there was incredible wealth generated, Investors were rewarded, but so were the founders, sponsors, and employees! There was great wealth created as these innovators and disruptors [along with a mix of more traditional companies] were rewarded.

I am extremely concerned about the employee wealth lost. I cannot imagine the personal wealth destruction that has occurred for many, especially mid-level to mildly senior employees. Just enough of a taste of the equity exposure to do well. Many have restrictions so have not exited and many had options, not all of which were struck at zero, so they may be back to zero, That wealth lost has to translate into lower economic activity, especially as the losses seem more persistent than they might have been a few months ago!

But investors have also been hit hard, and possibly harder than most people factor in.

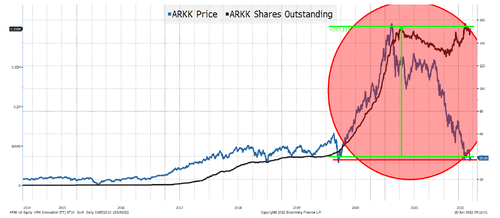

I will use ARKK here to illustrate an important point and why a subset of investors is in far more financial difficulty than might be apparent [assuming "traditional" portfolio construction].

ARKK, not accounting for dividends, is back to where it traded in the aftermath of the COVID shutdowns in March 2020. The number of shares outstanding has almost tripled since then. Yes, the number of shares traded daily is large and they frequently change hands, but on average, this shows that some large number of shares were issued as the fund price rallied. Many of those investors [on average] were originally reworded, but now, on average, those shares are somewhere between small losses and serious carnage. ARKK is down to $7.7 billion in AUM as of Friday from a peak of $28 billion in March 2021. The bulk of that change in the market cap can be attributed to performance as shares outstanding are still near their peak.

I highlight ARKK because I don't feel like talking about individual companies, the portfolio has changed so much, the performance is more generic than company-specific, and ETFs are often just the observable "tip of the iceberg" of major trends that are more difficult to observe, but are still happening,

TQQQ, the triple leveraged QQQ, exhibits a similar pattern and all the gambling stocks are doing poorly, which I attribute to incredible wealth destruction for a subset of investors,

The three groups that I believe were most hurt are:

- Relatively young people, who took a very aggressive approach to trade/gambling [with relatively small amounts of money] that they can make back via their job earnings over time [or they might now need a job if they were living off of the trading/gambling money]. I don't see a material economic impact from this group, It may even encourage workforce participation,

- Aggressive disruptive investors. Many people went all-in on some version of a disruptive portfolio [I didn't even bring up those who treated mega-tech stocks as a bank account with dividends and upside], There could be some serious wealth lost here that will affect the economy [and is likely already affecting the economy],

- Employees, some of whom also adopted disruptive portfolios. As the likelihood of a near-term rebound recedes, there will be wealth preservation as a focus. The number of IPOs and SPACs that are not just below their all-time highs, but below their launch prices, is scary, and that really hurts the employees, or at least those who couldn't sell, didn't sell, or sold, but diversified into a disruptive portfolio.

This is all deflationary (which I’m told is a good thing] but I cannot see how this is a good thing for the economy or broader markets!

But the Economy is So Resilient?

I challenge this.

- If we have an inventory overhang, the economy may grind to a halt far quicker than many are expecting.

- If banks start tightening lending practices [clear evidence this is occurring and will likely get worse than better] we will see credit contraction and that will feed into the economy, rapidly.

- We have NEVER gone from low rates and QE to higher rates and QT successfully [we haven't had many attempts, but I remain convinced that QE is very different than rate cuts and that it affects asset prices quite directly - see Stop Trying to Translate Balance Sheet to BPS.

- The wealth effect must be bad overall and devastating to some segments.

My view is that:

- Things definitely hit faster than people realized. Often the inflection point has already occurred while many are still applying straight-line extrapolation to what they perceive to be the still “existing" trend.

- "Gumming" up the piping often leads to more problems, rather than a quick solution [and I completely believe the current high levels of volatility in markets and lack of depth in liquidity is a form of gumming up the pipes].

- If the problem hits the financial sector it is too late (unless immediate/strong support from central banks is provided). So far, the banking sector is looking good, though Europe is lagging behind the U.S, in that respect. The ECB came up with half-hearted efforts to reduce Italian bond yields relative to others. The JGB stuck to its yield curve targeting, but markets will soon just expect that to get reversed at their next meeting. Finally, the Fed, unlike in March 2020, will have difficulty reversing course and helping. The good news is so far this isn’t hitting the banking system, but I am watching this sector closely, especially in Europe.

Risk happens fast! It's a phrase often said, but often ignored. I'm not ignoring it right now.

Commodity Wars?

This is a bigger question and one that is coming up more frequently, but have we entered into a global "war" to secure natural resources? I think that, increasingly, this is the reality we live in and that will be inflationary, just like reshoring, onshoring, securing supply chains, and “transforming“ energy production/ distribution, etc., will all be inflationary longer-term as well,

But I've taken up too much space already today and that isn’t a question that needs to be answered to drive my current thinking,

Bottom Line

I am including what I wrote last week because it largely worked and my views haven't materially changed, I added some color and exactness on the views while definitely shifting from DEFCON 3 to DEFC0N2.

I want to own Treasuries here at the wide end of the range, but for the first time, I'm scared that we could break out of this range (big problem]. The 10-year finished almost unchanged on the week, going from 3.16% last Friday to close at 3.23% (it did gap to 3.48% on Tuesday]. The swings in the 2-year were even more "insane" given the level and maturity. So, as recession talk heats up, yields should go down, but I’d spend a bit of option premium protecting against a rapid gap to higher yields.

Credit spreads should outperform equities here, though both may be weak, (Verbatim from last week].

Equities could be hit by the double whammy of earnings concerns and multiple reductions. I am told there is a lot of support, but I think that we see new lows this week unless central banks change their tune, which seems incredibly unlikely). I still find it mind-boggling that we prefer recession to inflation.

Crypto should remain under pressure. I think bitcoin will be sub $20k< before it reaches $35k. Now I think it will be $12,000 before $24,000.

Have a great Father's Day and enjoy the Juneteenth long weekend! (Though I have to admit, I kind of wish markets were open on Monday because this is the trading environment that deep down, I have to admit, I enjoy!]

Commentary:

HUMAN SYNTHESIS

COPYRIGHTS

Copy & Paste the link above for Yandex translation to Norwegian.

WHO and WHAT is behind it all? : >

The bottom line is for the people to regain their original, moral principles, which have intentionally been watered out over the past generations by our press, TV, and other media owned by the Illuminati/Bilderberger Group, corrupting our morals by making misbehavior acceptable to our society. Only in this way shall we conquer this oncoming wave of evil.

All articles contained in Human-Synthesis are freely available and collected from the Internet. The interpretation of the contents is left to the readers and does not necessarily represent the views of the Administrator. Disclaimer: The contents of this article are of the sole responsibility of the author(s). Human-Synthesis will not be responsible for any inaccurate or incorrect statement in this article. Human-Synthesis grants permission to cross-post original Human-Synthesis articles on community internet sites as long as the text & title are not modified.

HUMAN SYNTHESIS