Woman to VG.NO: - Paid over 100,000 NOK to get a loan in Nordea Bank - Norway

VG.NO-MARKUS TOBIASSEN/ROLF J. WIDERØE/TORE KRISTIANSEN (PHOTO)

VG.NO - Published: Updated 09 June 2022 - less than 1 hour ago

A loan customer tells how she paid large sums to get a loan from Nordea. According to her, the loan agent told her that part of the money was going to employees inside the bank.

The woman in her 40s, originally from South America, had just received a loan from Nordea. Shortly thereafter, a loan agent turned up at her home wanting payment.

- He said "you can not play with these people", the woman says.

Lending agents are intermediaries who fix loans for customers.

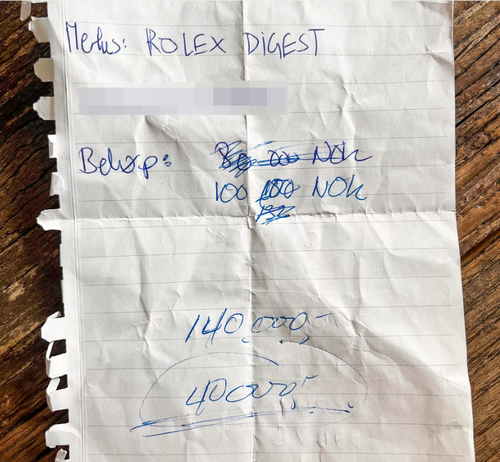

The woman says that the loan agent had a piece of paper with several sums on it. According to the woman, this was what the loan agent and his contacts in the bank should have. A total of 180,000 kroner. She shows the note to VG.

- He said there were several in Nordea who should have paid because one person is not enough. Others have to approve his job again. He talked about there being at least three people in Nordea, she says.

The note says "Rolex", then an account number, then several amounts.

The woman paid a sum of 100,000 kroner to the account number on the note, the woman's bank statements show.

Says she was scared

There was a disagreement about the remaining payment, the woman says. Then the loan agent, referring to her South American background, started talking about the Netflix series "Narcos", according to the woman.

"Narcos," tells the story of the various drug cartels in South America.

He said: "This is very serious. You play with money that is not yours. You and I have seen the Pablo Escobar series, and he was very restrictive and careful when someone did not pay what they were supposed to pay ", the woman recounts.

She perceived this as a threat and became afraid.

5000 kroner via Vipps

The woman says that she paid the loan agent an additional 5,000 kroner in cash and 5,000 kroner via Vipps. She explains the payment via Vipps by saying that she was not allowed to withdraw more cash.

VG has seen a confirmation of the Vipps payment. Messages show that the woman sent the loan agent a picture of an ATM, which shows a message that the amount she wants to withdraw is too large before she proposes to pay via Vipps.

Accused of corruption

The loan agent who came to the woman's home is the same one who is now charged with the extensive corruption investigation in Nordea.

He has been made aware of the contents of this article but does not wish to comment.

- My client cooperates with the police and denies criminal guilt after the charge. Beyond that, he has no comments now as the case is under investigation, says the man's defender, Farid Bouras in the law firm Elden.

Eight people are charged with gross corruption or complicity in gross corruption. Four of them are bank employees, two are affiliated with Nav, one is a loan agent and the last one has been appointed as a backer.

All deny guilt of criminality.

The police are investigating whether more than NOK 150 million in loans have been disbursed through a combination of forged papers and unfaithful servants.

VG does not know if the woman's borrowing is part of the investigation.

But she describes a mode that coincides with what VG described in an article on 31 May, the same day as the police raided Nordea:

In the article, VG described the market for loan agents in the Oslo area, where the customers are often immigrants or children of immigrants. Some lack language or social skills, which makes it more difficult for them to navigate banking alone.

Some of the agents are well-established, legitimate, and only charge the bank. Some operate in a gray zone and charge very high fees from customers. And others falsify loan applications or say they can obtain loans through corruption.

One of the loan agents tells in front of a hidden camera that he can fix loans through unfaithful servants in the bank, against large cash payments.

- It is for those who do not get a loan at all. We send them on, we have a credit manager, [in] the bank that we work with.

- They're fixing it. But it costs a lot of money, and it is not small loans. That's if you want five [million], six [million].

The woman in her 40s basically had good enough finances that she would probably be able to get a loan through an ordinary application to the bank.

But her Norwegian is unstable and a real estate agent recommended she go to Eiendomsfinans in connection with a home purchase.

Eiendomsfinans is a well-established player that has operated since the 90s - and is today one of the country's largest intermediaries of loans. At Eiendomsfinans, she met the loan agent, in the company's offices in Bygdøy Allé on the western edge of Oslo.

Initially, she received a loan, and Eiendomsfinans received a commission from the bank. She herself paid nothing.

When she later wanted to collect the mortgage and a car loan, she contacted the same loan agent. This time, the loan agent asked her to meet at an office hotel in Bryn, on the eastern edge of Oslo, where a number of small companies rent office space.

Now he said he would have money to get her a loan, the woman says. This is contrary to Eiendomsfinans' business model, which is to only charge the bank.

She agreed to this but says she was not told how much she would pay until after the loan was granted.

The lending agent also wanted them to start communicating on Whatsapp, which is encrypted.

The woman then sent the loan documents to an anonymous email account.

After the loan was granted and the payment was completed, the loan agent asked her to delete all dialogue. The woman chose instead to take care of it.

- Did you delete everything? please confirm, it says in a message from the loan agent.

"He should have everything in cash"

VG has also interviewed another customer, who says that he first met the same loan agent in the offices in Bygdøy Allé. The man wanted to buy a home but did not have a high enough income to get the loan he needed.

- With a smile, he said to me: "Then you must come to meet me in my other office". He said I should take all the documents on a USB stick. I should not send it by email, says the customer.

He also then met the loan agent in the other premises on the eastern edge.

- Just under 200,000 he said it cost. Everyone should have their bit. He should have everything in cash, he said.

The man says he declined the offer because he "sensed owls in the moss".

Used the office of a smaller loan agent

On Tuesday this week, VG visited the office in Bryn.

Employees at other companies that rent space on the same floor confirm to VG that the loan agent has used the office for several years.

The premises where the loan agent from Eiendomsfinans sat is rented by another, smaller loan agent.

The owner of this company denies being involved in the case in any way. He says he only borrowed one office space, and that the meetings with the customers must have taken place in common areas, not in his office.

- I have nothing to do with him and his operation. This is a serious matter and I expect the police to do their job properly. I take care of everything and do not want my name to be associated with this in any way, he says.

TIP US

Do you have information about this case or want to share something with VG?

The journalists can also be contacted in an encrypted message via Signal or Whatsapp. Use SecureDrop for particularly sensitive tips.

Markus Tobiassenmarkus.tobiassen@vg.no+47 902 03 279

Rolf J. Widerøerolf.j.wideroe@vg.no+47 913 79 538

COPYRIGHTS

Copy & Paste the link above for Yandex translation to Norwegian.

WHO and WHAT is behind it all? : >

The bottom line is for the people to regain their original, moral principles, which have intentionally been watered out over the past generations by our press, TV, and other media owned by the Illuminati/Bilderberger Group, corrupting our morals by making misbehavior acceptable to our society. Only in this way shall we conquer this oncoming wave of evil.

Commentary:

Administrator

HUMAN SYNTHESIS

All articles contained in Human-Synthesis are freely available and collected from the Internet. The interpretation of the contents is left to the readers and do not necessarily represent the views of the Administrator. Disclaimer: The contents of this article are of the sole responsibility of the author(s). Human-Synthesis will not be responsible for any inaccurate or incorrect statement in this article. Human-Synthesis grants permission to cross-post original Human-Synthesis articles on community internet sites as long as the text & title are not modified