HELLOOO,does'nt anyone care?

Written in November 2009 by The Otium Post

Note. This letter was sent to all the members of the Norwegian Parliament as well as to the Norwegian Inland Revenue Department and other government departments.

Dear Sir/Madam

The more I consider the fate of 'the minimum pensioners', the more I see the monstrosity in the consequences it has for us. Why are the weak and defenseless in society hung out in this way? And the worse thing is that no one seems to care! In Norway, they think only of themselves. First, their low but still statutory minimum pension was reduced by the 15% source tax which they have no possibility of receiving a refund of the tax in their country of residence. Additionally, all deduction rights were removed, including the minimum deduction rule and also the special allowances for age. Something so brilliantly malicious!

I strongly doubt the legitimacy of this decision, specifically designed for the minimum pensioners domiciled abroad. One can not deprive a group of humans of their justful rights just because they have chosen to settle in another country. Nor can the result of a new law reduce their pension to become less than that of their counterparts in Norway. As the expatriate pensioners now have the status of being taxable to Norway, they should also be entitled to claim their rights as taxpayers, i.e the minimum deduction rule must still apply, as well as other special allowance rules.

It can not possibly be legal to separate the tax claims from the current rules only for a group of citizens just because they are domiciled outside Norway.

Norway, in accordance with a tax treaty with Brazil, has the right and now also deducts tax from the minimum pensioners, it does not give the tax authorities in Brazil the opportunity to either tax or refund tax deducted in Norway. In order for us to be equated with the minimum pensioner's conditions in Norway, we have thus received the following paragraph in the letter from the Treasury Department which should also be applicable outside the EU:

"If the taxpayer after the introduction of source tax on pension is subject to taxation in Norway of all or virtually all their income, the tax limitation rule will apply. It, therefore, allows the taxpayer not to pay income tax or National

Insurance contributions to Norway. "

Note also that Brazil has very strong laws on the protection of citizens' rights and privacy, more than is the case in Norway. These laws cover not only national citizens but also foreigners residing in Brazil. It, therefore, does not allow public access to private tax affairs or bank accounts. For this reason, the finance minister's intervention in Brazilian tax matters with a demand for a common bilateral tax collection system from the 'minimum pensioners' domiciled in Brazil is not acceptable.

I will in this context also mention the supreme court decision of 11 December. 2009 in the StoltNilsen case where the Supreme Court considered whether the Norwegian state was entitled to demand a copy of the British taxpayer's tax returns and final tax settlement as proof that the taxpayer was a resident of the UK for the purpose of a tax treaty. The Supreme Court ruled in conclusion that the Norwegian state was not entitled to make such a claim as proof of tax residency in the United Kingdom.

Most minimum pensioners in Norway can not survive without additional support for housing expenses, medicines, and free medical insurance. This support has been completely removed for the 'minimum pensioners' domiciled abroad, who must arrange for private health insurance and medicines locally in their country

of domicile. Another fact that the Ministry of Finance was not aware of when they took their hasty decision to introduce this source tax for the minimum pensioners are that they now fall below the minimum income required by Brazil for a

retirement visa, in Brazil the minimum income requirement is the U.S. $ 2,000. Considering my total tax deductions as from 1 January, I am now under this minimum income requirement and am at risk of not having my visa renewed.

The 'minimum pensioners' as a group should have retained the same rights as their countrymen living in Norway, furthermore, this new tax should not be applied retroactively for pensioners who have already moved abroad several years ago. This decision is also against the Norwegian constitution, paragraph § 97 which states that 'no new law shall have retroactive effect'. Denmark took the sensible decision not to impose the source tax retroactively but only from the date of the introduction of their source tax. Those of us who moved out several years ago relied on the predictability of our pensions and have made our new lives here that can not easily be changed. Several have entered into marriages with citizens of their new country of domicile and also have children who attend school here.

In my opinion, the minimum pensioners who settled abroad should on the contrary be rewarded with a 15% 'flagged out tax' for saving the government future health and extra costs in Norway. Considering the oncoming 'old peoples wave' expecting to break in 2014, any other country would have been delighted to allow their senior citizens to retire to countries outside of Norway even with some financial benefits on their way. In 2011 comes further trials with the new pension reform obligating us to submit a tax return on a yearly basis with who knows what subtlety of information requirements from the Brazilian tax authorities, which adds significant costs and psychological pressure on the old and infirm before they are allowed to receive their pensions. All this is because the finance minister in his ignorance of conditions outside Norway have made the retirement a hell for a

a small group of people.

Let me provide some information about the facts:

1. Brasil is a country with 186 million inhabitants, Norway's population would fit into a medium-sized city here. The systems that control this population is not necessarily as flexible as the Norwegian tax system, nor have the employees much education and has been instructed to perform few and simple tasks to carry out in his position, which must be followed to the letter and allows NO variations which could cost them their job. Moreover, for the economy to go around in this vast country, they employ people with little or no education at the lowest possible wage of R$ 450 per month or approx. US$ 250. With this salary, only the bare essentials are done and there are no prizes for trying to do something out of the ordinary which you are unfamiliar with, it will only cause trouble.

2. The minimum pensioners normally live in resort towns along the coast which lie many hours of travel from capital cities or larger cities where you only have access to tax officials of lower rank and experience. If able to connect with a more senior official in one of the major cities, he will often use the Brazilian 'jeito' rather than try to solve your problem. He often has no idea what or where Norway is, far less familiar with the contents of a tax treaty signed with Norway in 1980, and have no idea about the 15% source tax which has not yet been renegotiated by

Norway and which, in addition, deprives Brazil of significant tax income. As most of us speak the language rather poorly it means that we must engage both an interpreter as well as a lawyer to be present at such meetings with the Brazilian tax authorities. These visits can easily cost a couple of months' pension.

3. The minister of finance's demand for a 'Certificate of Residence' from the tax authorities as well as confirming this nonrenegotiated tax treaty between Norway and Brazil, is an impossible task, where the minimum pensioners are given administrative duties. This also conflicts with Norwegian law. I have submitted proof of residence as well as tax identification reference (CPF) which all domiciled foreigners must have in Brazil. Further, I have submitted passwords certified copy of my tax status as 'REGULAR' which means that I am uptodate with my tax. The

Norwegian government pension office has sent my pension payment advice to my address for 8 years and in addition a 'livingcertificate' every year, so they should have registered my residence. Yet this is not accepted by the Norwegian Finance Minister and the 15% tax deduction continues.

I received the initial advice from the tax office about the source tax via a form I received from the Norwegian tax office at the end of November 2009. I responded with several emails and faxes from the 1st of December but received negative responses in the post only 3 months afterward. Since then I have fought with all the tax departments which all make the same unrealistic requests and would not listen or help in my desperate financial situation. I have sent extensive faxes and emails to both the prime minister, the finance minister, the Norwegian tax office, and our House of Parliament but with very little feedback. It does not appear that anyone is interested in our fate and that our small group of senior citizens residing abroad will be an acceptable 'sausage in the slaughterhouse'

as a sacrifice on the altar of the source tax.

Thank you for your attention ..

Tore Christiansen

Sao Paulo – Brazil

Note. This letter was sent to all the members of the Norwegian Parliament as well as to the Norwegian Inland Revenue Department and other government departments.

Here is the first letter I wrote to The European Court of Human Rights.

30/11/2013

re. Discrimination & breach of human rights in the Kingdom of Norway

On behalf of all 'minimum pensioners' with permanent residence outside of Norway, I wish to report a serious breach of human rights and discrimination laws.

The bottom line is that, as from the introduction of a new 15% 'source tax' from 1. January 2010 on all pensioners residing permanently outside of Norway, the lowest paid 'minimum pensioners' are also being forcefully deducted this tax, whilst their 'fellow minimum pensioners' living in Norway are not paying any tax at all. This discriminating, forced tax deduction also applies to pensioners who emigrated from Norway 7 years ago. The Norwegian constitution §97states that no new law can have a retroactive function. Top government officials and other high-earning pensioners also pay this flat rate 15% tax where they previously were paying in excess of 50% tax, This clearly creates a discriminating, reversed 'RobinHood' effect.

The minimumpensioners living in Norway furthermore enjoy free membership in the Norwegian health service and also other benefits. They also have the opportunity to apply for added financial support towards living expenses. They

are also entitled to use a minimumsalary tax relief rule which, for the minimumpensioners means a zero tax deduction from their pension. All of these extra benefits have been removed from the minimumpensioners rights after emigration from Norway.

We have appealed to all the Norwegian government officials without hope of any help in our dire economic situation and are hoping you will help us to have justice done.

Yours sincerely

Tore Christiansen

Norwegian Citizen

Birthdate: 12101933

email: tore.christiansen@gmail.com

----------------------------------------------

Thank you for your reply of the 15 September 2010 with enclosures. As briefly explained in my original letter of 09.06.2010, I belong to a minority group of Norwegian so-called «minimumpensioners» who married a Brazilian citizen in Norway and moved permanently to Brazil in May 2003 to enjoy my retirement.

To further explain, the «minimumpensioners» residing in Norway have the rights to use the 'minimum tax deduction rule' which in effect means that no tax is deductible. They are for that reason also not required to submit annual tax returns. They also have the benefits of free membership in the Norwegian state health service.

Prior to my departure from Norway in 2003 I had duly notified the Norwegian tax authorities of my decision to settle in Brazil and received their written confirmation that I was exempt from paying tax to Norway. After 6 years of domicile in Brazil, I was in Nov 2009 suddenly advised that a new 15% «source tax» had been retroactively introduced for all retired persons domiciled outside of Norway, forcibly deducted at source as from 01.01.2010. A 15% tax deduction may not be such a disaster for someone receiving a normal average pension, but for those of us having to survive on the equivalent of EUR 1.000. per month received from Norway, it surely is a disaster, which in my case means I've had to give up the local health insurance for both myself and my wife and are barely surviving from day to day with help from my inlaws.

This was Not the retirement I had envisaged when I planned my retirement prior to departure from Norway in 2003 when I believed I could trust the agreements made by the Norwegian government regarding the predictability of their promises.

The Norwegian governments «ot.prp.nr 20 (20082009)» makes the following statement regarding the introduction of the «source tax»:

«The proposal will ensure that the Norwegian tax base shall not be unreasonably reduced. Furthermore, the proposal shall prevent tax adjustments in connection with the internationalization of the labor market, private pension savings, and pension recipients' choice of domicile.»

The above statements are clearly in conflict with the right to free choice of domicile without discrimination. (Ref. Protocol No. 4 article 2)

Page 2.

I also have the right to select my marriage partner from any country, and if preferred, to select my domicile in my wife's native country without discrimination or hindrance. (Ref. Rights and freedoms article 12) The «minimumpensioners» domiciled outside of Norway are forcibly being deducted 15% 'source tax' whilst the «minimumpensioners» residing in Norway are NOT. Furthermore, we are not being compensated for the loss of free membership in the Norwegian health service, nor are we receiving the benefit of non-tax payment for the month of

December which applies to ALL pensioners residing in Norway. (Ref. Rights and freedoms article 5/4 and article14) A small group of «minimum pensioners» domiciled outside Norway are being subjected to persecution and harassment as well as demands to carry out official negotiations on behalf of the Norwegian government to re negotiate and agree on the bilateral tax agreement with Brazil dated May 1980.

Old and infirm senior citizens do not have the ability or capacity to enter into complicated tax negotiations in a foreign language and do not have the financial resources to engage lawyers and interpreters. If they do not comply, all or part of their rightful pensions will be withheld at the source. Understandably, this is causing great worry and anxiety and is an impossible, and un acceptable 'catch 22' situation. I have personally exhausted all official avenues of complaints about the application of this new tax without any hope of help and I also speak for hundreds of other senior citizens around the world who without any fault of their own find themselves in this unjust and terrifying situation.

We are all also represented by the registered organizations of EMIGRANT1 and Nor Alliansen who are working for the betterment of the conditions of the senior citizens domiciled outside of Norway, the following being an extraction from one of their letters to the Norwegian authorities: Source tax for pensioners immigrating to Brazil from Norway. To better express and document the distinctions that are necessary to visualize the mechanism that is provided during the application of internal Norwegian tax law regarding socalled source tax combined with the new Double Taxation Agreements (DTAs), allowing Norway to withhold tax from pensions and social security earned in/sourced from Norway, and that the different states have entered into or will enter into in the future with Norway. This “mechanism” is undermining the basic concept of bilateral agreements. The “mechanism” is well explained later in this letter. By applying the same “mechanism” in my double taxation case in Brazil, the Norwegian state

demonstrates how this “mechanism” causes the internal Norwegian tax law to take precedence over the DTA.

The consequence of the above-mentioned “mechanism” is also an (hidden) extension of Norwegian sovereignty into other jurisdictions. The current action initiated by the Norwegian government is “a threat to the human economic rights for all Norwegian pensioners settled worldwide”. Upon further consideration regarding this matter, I think it is more correct to state that the current Norwegian government during the implementation of the above mentioned “mechanism” in operation as of 20100101, is discriminating a minority group that has earned their pension and social security rights in Norway and decided to settle in another jurisdiction than Norway. The discrimination of this minority group has been put into effect by violating: The Norwegian constitution § 97, The four freedoms in EU, and by providing disinformation or not adequate or holistic information to the Norwegian parliament during the preparation process of the new socalled source tax and Ratifications of new/amended DTA's.

Page 3.

The serious effects/consequences of the above-mentioned “mechanism” which is the combination of these two elements are not explained in any document/paper. In nature, this combination is an instrument for double taxation. The Norwegian tax rate for the socalled source tax has no “ceiling”. The tax rate for the so-called source tax can be adjusted yearly. The starting point is 15%. Next year it may be adjusted to 20% or whatever the Norwegian parliament decides. The intention or target to achieve these effects is (indirectly) documented in the preparation papers for the introduction or implementation of the so-called source tax. By implementing the described mechanism, the cash flow back to Norway is assumed to be enormous in a long term perspective compared to the short term cost

Norway has during their contributed to many development projects around the world.

Please initiate investigations/actions to stop the above-described discrimination of a minority group that has earned their pension and social security rights in Norway and has decided to settle in another jurisdiction than Norway. From a human rights point of view, Norway is not in a position to dictate any level or percentage of withholding earned rights or money in Norway for a minority group, or any other group or person, having a permanent residency in another jurisdiction than Norway. In conclusion, please bear in mind that as a 76-year-old senior citizen without any financial means to engage or consult a Norwegian lawyer from Brazil and with limited knowledge of how to present my case,I hope you will bear over with any failings or shortcomings and do your best to help me and my fellow senior citizens to persuade the Norwegian government to drop this unjust tax demand at least for the 'minimumpensioners' domiciled outside

of Norway and make a full refund of the total amounts deducted, with interest to compensate for our loss.

With thanks and kind regards

Tore Christiansen

Costa verde – Brazil

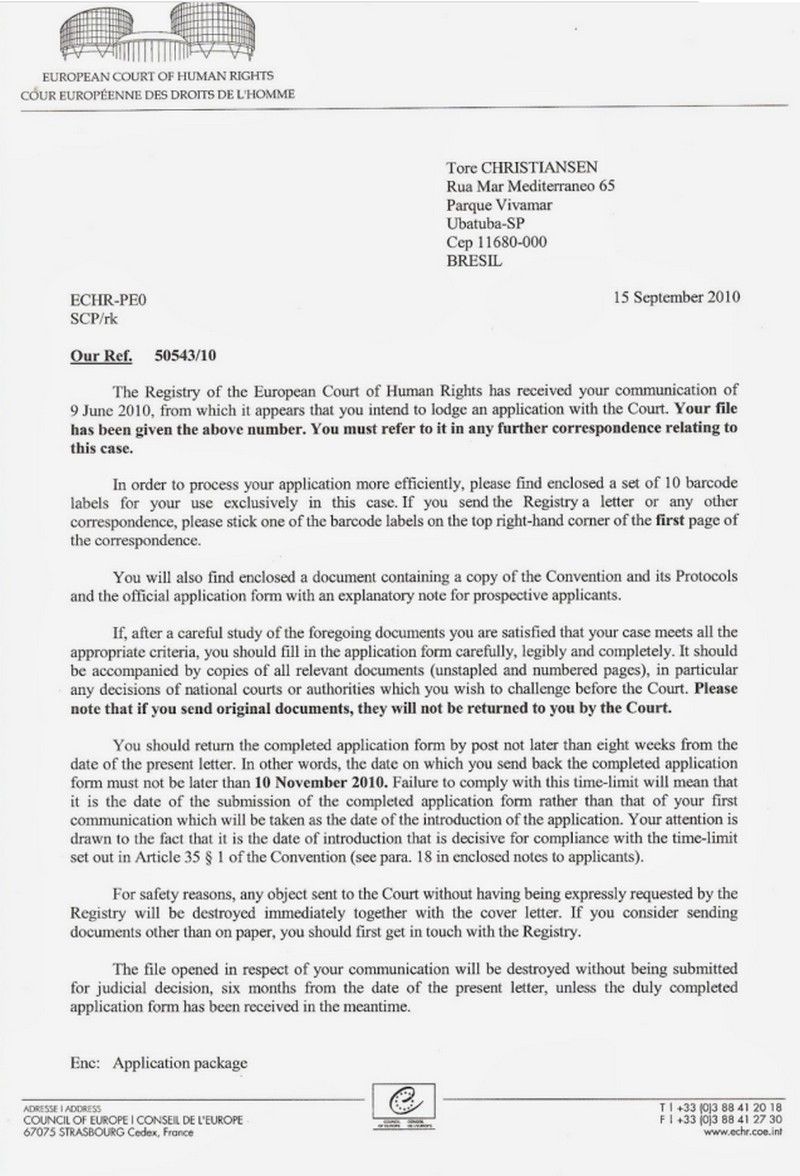

Here are instructions from the ECHR on the procedure for applying for treatment:

In total, I sent 12 fax messages that also had to be sent as regular mail. I also filled out a ´book´ with questions from ECHR and sent a bunch of supporting documents. The result was unfortunately negative after a long wait and many reminders. ECHR rejected the complaint due to incomplete processing and for not having to utilize ALL funds through the Norwegian judiciary. (Which I had neither advice nor competence for.)

COPYRIGHTS

Copy & Paste the link above for Yandex translation to Norwegian.

WHO and WHAT is behind it all ? : >

The bottom line is for the people to regain their original, moral principles, which have intentionally been watered out over the past generations by our press, TV, and other media owned by the Illuminati/Bilderberger Group, corrupting our morals by making misbehavior acceptable to our society. Only in this way shall we conquer this oncoming wave of evil.

Commentary:

Administrator

HUMAN SYNTHESIS

All articles contained in Human-Synthesis are freely available and collected from the Internet. The interpretation of the contents is left to the readers and do not necessarily represent the views of the Administrator. Disclaimer: The contents of this article are of sole responsibility of the author(s). Human-Synthesis will not be responsible for any inaccurate or incorrect statement in this article. Human-Synthesis grants permission to cross-post original Human-Synthesis articles on community internet sites as long as the text & title are not modified