The Financial Services Authority charges AKO Capital trader

By Matt Turner

Updated: April 28, 2010 7:59 pm GMT

UK regulator charges AKO hedge fund trader with conspiracy as insider trading clampdown continues apace.

The Financial Services Authority has charged a former execution trader at a $2.5bn (€1.9bn) London hedge fund with conspiracy to commit insider trading, as the UK regulator continues its clampdown on market malpractice.

The FSA said today it had charged Anjam Ahmad with one count of conspiracy to commit insider dealing contrary to Section 1 of the Criminal Law Act 1977.

He was charged at Snow Hill Police Station in the City of London, the same police station where seven men were charged with insider trading last month as part of Project Saturn. He has been bailed to attend City of Westminster Magistrates' Court on May 7, 2010

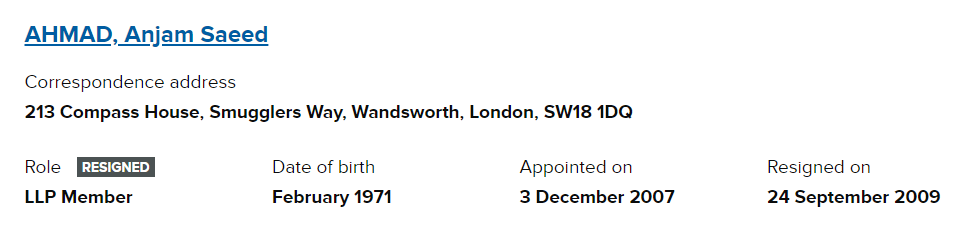

Ahmad was most recently with AKO Capital, according to the FSA register, a $2.5bn London-based European equity hedge fund.

The offences relate to trading in 22 different shares between June and August in 2009. AKO Capital stressed in a statement that it was not a subject of the investigation and that it was cooperating fully with the regulator.

In a statement on its website, AKO Capital said: " We were shocked when, subsequent to Mr. Ahmad's departure from AKO Capital, we were notified by the FSA that he was a subject of an FSA investigation into his personal dealings."

It added: "We have, of course, been cooperating fully with the FSA. The charges relate to Mr. Ahmad's activities in a personal capacity."

The charges follow the searches and arrest of three men on January 28, 2010. The FSA has so far brought no charges against the other two men. Ahmad is being represented by Robert Brown, a partner at Corker Binning. Brown declined to comment on the charges. Calls to Ahmad's home address went unanswered.

According to the FSA register, Ahmad joined AKO Capital in 2007, having previously been employed at Citigroup, where he worked in equity derivatives.

The charge is the latest in a long line of insider trading charges. The FSA has secured five sentences of imprisonment in relation to insider dealing, though one was suspended. In addition, it is currently prosecuting three other insider dealing criminal case.

Hedge fund trader sentenced for insider trading

A former hedge fund trader at AKO Capital has been given a 10 month suspended prison sentence and fined £50,000 for insider trading.

by IAIN MARTIN Posted 22 JUNE, 2010

A former hedge fund trader at AKO Capital has been given a 10 month suspended prison sentence and fined £50,000 for insider trading.

Anjam Saeed Ahmad pleaded guilty to one charge of conspiracy to commit insider dealing after accepting a plea bargain from the Financial Services Authority.

Southwark Crown Court heard that 39-year-old Ahmad had conspired with another individual over 19 different securities using his inside information about AKO's plans. Ahmad was sentenced to 10 months imprisonment which was suspended for two years, 300 hours of community service and a £106,000 confiscation order was made against him.

‘It is only because of the quite exceptional mitigating factors such as the swift and timely admissions to the FSA and other matters such as the SOCPA agreement that saves you from immediate imprisonment today,’ said Judge Rivlin at Southwark Crown Court.

Ahmad of Wandsworth, London will co-operate with the FSA in its investigation into the individual he passed insider information on to. Ahmad has also agreed to pay the FSA £131,000 which he made from commission kick-backs for placing trades with a separate equity broker between February and August 2009.

Ahmad worked at AKO as a trader and risk manager since December 2007 and before that he worked at investment bank CitiGroup.

‘The FSA has shown that we will take tough action and use all the tools at our disposal to achieve our aim of credible deterrence in the financial markets,’ said Margaret Cole (pictured), director of enforcement and financial crime at the FSA. Cole said this was the first time the FSA had used a plea bargain arrangement and it had earned Ahmad a significant cut in his sentence.

WHO and WHAT is behind it all ? : >

VISIT THE HUMAN SYNTHESIS ACHIVE

The bottom line is for the people to regain their original, moral principles, which have intentionally been watered out over the past generations by our press, TV, and other media owned by the Illuminati/Bilderberger Group, corrupting our morals by making misbehavior acceptable to our society. Only in this way shall we conquer this oncoming wave of evil.

Commentary:

Administrator

HUMAN SYNTHESIS

All articles contained in Human-Synthesis are freely available and collected from the Internet. The interpretation of the contents is left to the readers and do not necessarily represent the views of the Administrator. Disclaimer: The contents of this article are of sole responsibility of the author(s). Human-Synthesis will not be responsible for any inaccurate or incorrect statement in this article. Human-Synthesis grants permission to cross-post original Human-Synthesis articles on community internet sites as long as the text & title are not modified.

The source and the author's copyright must be displayed. For publication of Human-Synthesis articles in print or other forms including commercial internet sites. Human-Synthesis contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of "fair use" in an effort to advance a better understanding of political, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than "fair use" you must request permission from the copyright owner.