Blackrock will make GREEN sustainability its investment strategy.

Tuesday 14 January 2020 11:39 am

What Blackrock’s climate change strategy overhaul actually means

The investment titan, which manages $7 trillion (£5.4 trillion), has pledged to overhaul its investment practices and introduce new investment products as part of what founder and chief executive Larry Fink called “a fundamental reshaping of finance”.

But what changes has Blackrock pledged to make, and what impact are they likely to have? City A.M. breaks down the key pledges below.

Exiting (some) thermal coal producers

Blackrock has pledged to cut companies that derive 25 per cent or more of their revenues from thermal coal from its actively-managed portfolios due to the environmental damage they create.

“Thermal coal is significantly carbon intensive, becoming less and less economically viable, and highly exposed to regulation because of its environmental impacts,” said Fink.

“With the acceleration of the global energy transition, we do not believe that the long-term economic or investment rationale justifies continued investment in this sector.”

The asset manager will move to exit positions in these coal producers by the middle of this year. Fink added that Blackrock would “closely scrutinise” firms that are heavily reliant on thermal coal, which would include power companies.

However questions have been raised about the impact of Blackrock’s pledge to ditch thermal coal. For many of the biggest mining firms, coal production is just a small part of their overall business — meaning they are unlikely to be affected.

Sustainability to become Blackrock’s ‘standard offering’

The asset manager will make sustainability its “standard offering” across the investment solutions it offers to clients, making “sustainable funds the standard building blocks in these solutions wherever possible”.

This will include offering environmentally responsible versions of popular funds in its flagship model portfolios, Ishares investment platform, and retirement products.

Increasing transparency surrounding its investments

Blackrock said it wants investors “to be able to clearly see the sustainability risks of their investments”.

To help this, the asset manager will begin showing investors data on the controversial holdings and carbon footprints of its mutual funds by the end of the year.

It will also integrate new tools for assessing environmental, social and governance (ESG) criteria into its risk management platform, Aladdin. These will include tools to assess climate risk and to calculate companies sustainability-related characteristics.

More environmentally-conscious funds

The investment giant will double its offering of ESG exchange traded funds (ETFs) — baskets of securities such as stocks that are traded on exchanges, which often track an underlying index.

ETFs tend to have much lower costs for investors, as they allow them to hold a basket of equities without buying them all separately. ETFs that track an index are also cheaper to operate than actively-managed funds.

Blackrock said this morning it intends to double its offering of ESG ETFs to 150 over the next few years.

Changes to active investments

All of Blackrock’s active portfolios and advisory strategies will be fully ESG integrated by the end of this year, it said.

According to the asset manager, this means that “at the portfolio level, our portfolio managers will be accountable for appropriately managing exposure to ESG risks and documenting how those considerations have affected investment decisions.”

Blackrock says it will consider “ESG risk with the same rigor that it analyzes traditional measures such as credit and liquidity risk”.

The company will also move to reduce ESG risk within its active strategies, which are responsible for $1.8 trillion of assets. This includes exiting positions in thermal coal producers.

WHAT IT REALLY MEANS FOR SMALLER INVESTORS AND OUR PEOPLE

BlackRock's new 'sustainable rulebook' will in effect take control of the market, carefully selecting WHO they will allow into their 'sustainable club', at the demise of all others. BlackRock will give you the Green Stamp, or not.

This Green Stamp will eventually also apply to the productions of the 'stampholders' which will be given financial preferences 'on the shelf' over local production owing to their manufacture in countries with low labor costs. This, at the great detriment to local producers and loss of employment. EXACTLY following the agenda of the 'global elite'.

ORIENTATION ON ESG FUNDS

Financial Times + Billy Nauman in New York MARCH 4 2020

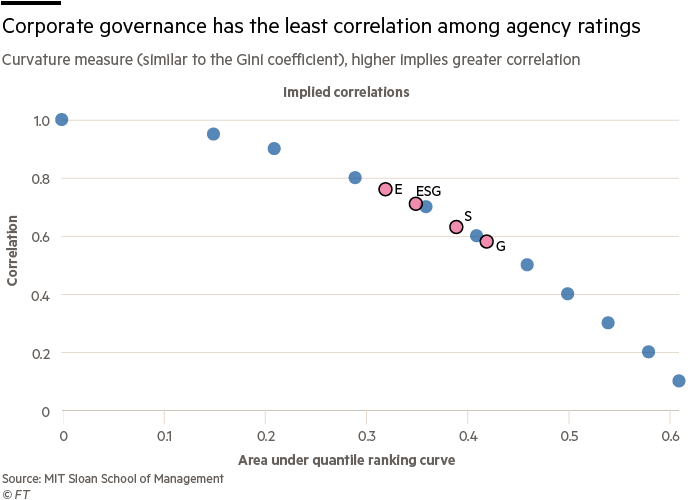

Heavy flows into ESG funds raise questions over ratings Providers under spotlight on the integrity of their scoring systems Ratings are reviewed annually and updated to incorporate new risks as they pop up. A growing number of investment indices now hinge on companies’ rankings for environmental, social and governance criteria, and some banks are even offering better borrowing terms to companies with strong ESG scores. But these are not like credit ratings, which are regulated, and tend to be governed by specific triggers such as a company breaching a certain threshold of leverage.

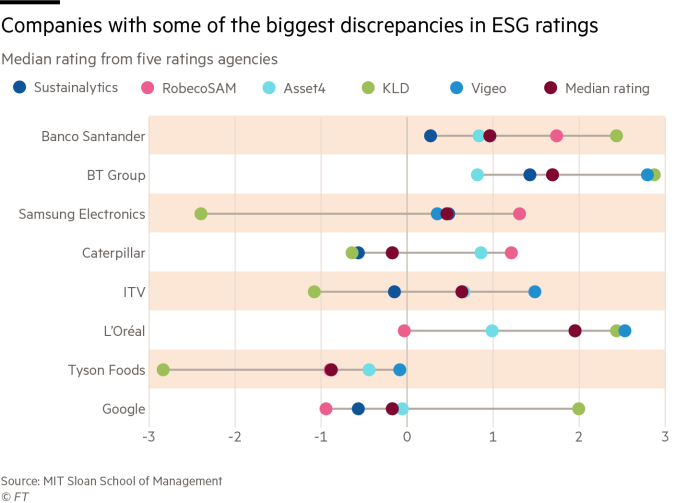

And with so many different methodologies on the market, from a growing number of providers, there can be a wide spread of views on the same company. Facebook, for example, was docked to a rating of 21 out of 100 last year by S&P Global, which worried about its privacy and transparency standards. Yet MSCI’s rating for the social media platform has hovered in the “average” range, fluctuating between double-B and triple-B. ESG ratings are becoming “increasingly important, but the level of public scrutiny and supervision of them . . . is far from optimal,” said Steven Maijoor, chair of the European Securities and Markets Authority, at an event last month.

How do ratings firms go about the scoring process? The first step is often determining what factors are material to the company the agency is looking at. Sustainalytics, one of the most prominent ESG ratings providers, has set out 138 “sub-industry” groups and designates “exposure scores” for each factor within each sector, according to Simon McMahon, head of ESG research. For example, mining companies may be more vulnerable to the physical effects of climate change than the tech sector, so those risks are weighted more heavily in the miners’ ratings. Ratings are reviewed annually and updated to incorporate new risks as they pop up.

“It’s a combination of a data-driven process and a process that incorporates analyst insight,” said Mr McMahon. Paris-based Vigeo Eiris, one of the world’s oldest ESG rating agencies, now owned by Moody’s, has identified 38 so-called “sustainability drivers” and sets out a weighting for each, across 40 different industries. JetBlue, an airline that recently signed a loan tied to its Vigeo Eiris ESG score, is rated on about two dozen drivers relevant to the airline sector, said Benjamin Cliquet, the company’s head of ESG-linked loans. Vigeo Eiris also updates its assessments frequently.

But in cases such as JetBlue, where it is important to be able to compare year-on-year data to set the terms of its loan, the agency will produce reports consistent with the original methodology so that BNP Paribas, the bank providing the loan, can make an apples-to-apples comparison. How does a rater find the data it needs? One of the biggest challenges in ESG ratings comes from self-reported data, said Remy Briand, head of ESG at MSCI. For starters, many companies offer up data only on metrics where they perform well, he said. On top of that, the data is typically unaudited.

“You have to look for evidence elsewhere to make sure companies are doing what they’re saying,” said Mr Briand, explaining MSCI spends a lot of time looking at other data sets such as regulatory fines or product recalls to vet what they receive from companies. This has paid off in cases such as Equifax, the consumer credit agency that revealed a breach of its systems in September 2017. MSCI’s ESG team had downgraded the company to triple-C more than a year earlier. “Privacy and security [carried] a big weight in that sector, and we scanned [databases] and saw they already had a poor record of being hacked and not doing anything about it,” he said.

Sustainalytics’ research is also based on a combination of self-reported data and external verification. And if a matter has been deemed material, Sustainalytics will score a company on it whether or not it provides information, said Mr McMahon. “We have identified the risk. There’s a need for that risk to be managed.” How will this work out? Baer Pettit, president of MSCI, expects there may be some convergence between scores from different providers, but he does not believe it will ever achieve the kind of homogeneity of credit ratings. This will provide little consolation for investors looking for quick and easy ways to put a sustainability stamp of approval on their portfolios.

But the providers argue that a certain level of variance is a good thing — and shows that ESG analysis can be used by investors to gain an informational edge. Mr Pettit compares the market to Wall Street analysts’ ratings of listed companies, where there tends to be a wide range of views. “We are making a forward looking judgment with a variety of inputs, not all of which are standardised,” he said.

“Turning unstructured data into actionable insights is hard to do,” added Mr McMahon from Sustainalytics. “That’s why there’s an opportunity.”

WHO and WHAT is behind it all ? : >

The bottom line is for the people to regain their original, moral principles, which have intentionally been watered out over the past generations by our press, TV, and other media owned by the Illuminati/Bilderberger Group, corrupting our morals by making misbehavior acceptable to our society. Only in this way shall we conquer this oncoming wave of evil.

Commentary:

Administrator

HUMAN SYNTHESIS

All articles contained in Human-Synthesis are freely available and collected from the Internet. The interpretation of the contents is left to the readers and do not necessarily represent the views of the Administrator. Disclaimer: The contents of this article are of sole responsibility of the author(s). Human-Synthesis will not be responsible for any inaccurate or incorrect statement in this article. Human-Synthesis grants permission to cross-post original Human-Synthesis articles on community internet sites as long as the text & title are not modified.

The source and the author's copyright must be displayed. For publication of Human-Synthesis articles in print or other forms including commercial internet sites. Human-Synthesis contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of "fair use" in an effort to advance a better understanding of political, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than "fair use" you must request permission from the copyright owner.