This is a post from one of my colleagues in Emigrant1 regarding victims of the 15% Source Tax.

By Tore Christiansen - Sao Paulo, Brazil - 10 Aug 2017

This is an old post from Emigrant1, and I think it was so well written that it bears repeating. It has also been posted on the page of our Minister of Finance and Prime Minister, but will probably not be approved for display. It has also been sent by email to Gahr Støre and Hareide, who think that withholding tax is such a fair invention.

1. "It is very rare that I engage in discussions in forums like this. But now I think some people here are going overboard with their hateful posts against fellow countrymen and women who have taken up residence abroad in their last years. I myself am a minimum pensioner with less than NOK 160,000 and live in a medium-sized city in Southern Norway.

Due to my low pension, which is due to me dropping out of working life early due to congenital defects, my pension was low. I have accepted that. But I am lucky enough to live in Norway, one of the richest countries in the world. I receive NOK 6,420 monthly in housing allowance (my rent is currently NOK 9,950 a month), and NOK 77,000 a year.

I am medically dependent on that, but I can live at home. At least until further notice. But I receive prescription drugs for my heart disease (angina) and a previous heart attack and at the same time I have type 1 diabetes and have to take insulin 2-3 times a day. I am able to manage my medication intake myself with the help of the dosage that the weekly nurse gives day by day.

In total, I consume prescription drugs for what my doctor says amounts to NOK 28,000 a month, or NOK 336,000 a year. In addition, I have domestic help twice a week for cleaning and assistance with cooking (dinner for one week at a time). The value of this is estimated by the NAV office at NOK 2,800 a month, or NOK 33,600 a year.

My minimum pension is thus not NOK 158,900 a year, but NOK 605,500! And I don't pay a penny in taxes, nor have I for as long as I can remember. I, therefore, have a low tax capacity and have special subsidies and special deductions for services that I otherwise have to have.

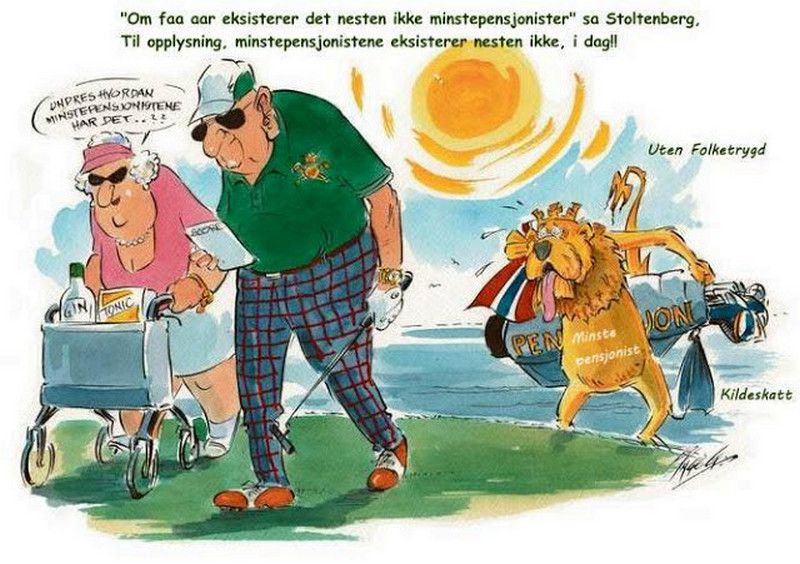

2. One of my neighbors moved abroad a few years ago, he had to sell his house and car to get approved for tax purposes. His pension is NOK 246,000 a year. From this, there is now 20.3% in withholding tax and social security tax (15% + 5.3%) Which is NOK 50,000. He has NOK 194,000 left. All elderly and disabled people living abroad must/should have health/hospital insurance. He is 66 years old and pays NOK 43,600 in insurance per year.

He now has NOK 150,400 left. He is a social man who likes to be around people, but he lives very soberly in an apartment with one bedroom and a bathroom, living room, kitchen, and balcony in an apartment complex. For this, he pays NOK 4,200 including cable TV per month. That is NOK 50,400 a year. Thus his pension was reduced to exactly NOK 100,000.

Now he will start "living life"... his last years in the hustle and bustle as the prophets of envy here on the forum should be called. He worked at NSB for 39 years before he retired, a bit troubled by sleep and joint pain, but I know he is. But he doesn't complain - and I know he uses sleeping pills now and then.

He is usually in Norway on holiday in the summers - and then the return ticket costs approx. NOK 6,000. He usually rents an apartment where I live for the 6 weeks he is here - and pays NOK 1,400 a week, which is NOK 8,400. This leaves him with NOK 83,600 a year.

He has family up north, with children and grandchildren whom he sometimes visits, and of course, he sends Christmas presents and birthday presents as our generation likes to do. This man who lives "in the hustle and bustle" as the prophets of envy call it, has NOK 80,000 - that's NOK 6,500 a month, which is approx. NOK 215 a day.

Note that he is not a minimum pensioner, but has a gross pension of NOK 246,000 a year. He is left with far less than the stock market speculators and what I can often reveal are people employed by the Swedish Tax and Welfare Agency (NAV) who throw rubbish at old toilers. Shame on you, damned slobs who sit at the computer and pass the time hatching fandom about a tiny group of Norwegians who are not a burden to Norwegian society.

Namely, only 4% of Norwegian elderly and disabled people have chosen to live abroad and cover their own expenses. Those of you who write disparagingly about them wish I could end up in my situation. As a disabled person, forced to live in Norway because of my illness. If I had usable health, I would do as my good friend did, living out my last years in sunshine and warmth.

I also couldn't help but tell a little about MY own case as a minimum pensioner, earlier also lived in Sørlandet before I got married in Norway in 2002 and emigrated to Brazil in 2003 when my wife would like to live near her parents. With a minimum pension of NOK 130,000 a year, I probably wouldn't have been able to survive in Norway with the high living costs either.

This means that after the deduction of 15% withholding tax, I am left with NOK. 112,000.- which will support me and my wife with health insurance, medicines, and all other normal living expenses or NOK. NOK 167 per person, per day in a country with almost as high living costs as Norway, if you don't live in a shack in the Amazon. We live near the megacity of Sao Paulo.

I don't even have the full minimum pension as I was 'born too early' in 1933, and Folketrygden was not founded before 1967, I think. Then I am deducted from the period of residence from when I was 16 in 1949 to 1967, i.e. a full 18 years. This calculation method may perhaps be ok for pensioners with a regular and high pension, but should certainly not be used for the minimum pension, which should be a minimum amount on which it should be possible to survive, i.e. not calculated according to earnings or length of residence. Rich Norway should be able to be so generous to those who, for various valid reasons, have not been able to build up a viable pension. We are today, all of us, worth 1.8 million each man and mouse.

From this, the tax authorities, therefore, find that it is all right to deduct an additional 15% withholding tax because rich merchants in Norway lose profits from the goods they can't afford to buy abroad. If I had lived in Norway, I would have been exempt from withholding tax and would also have been able to acquire a housing allowance and free membership in the National Insurance Scheme, as well as other supplements if necessary. None of the many grants mentioned under Point 1 are available to minimum pensioners living abroad.

I got prostate cancer 5 years ago and had to pay for a three-month stay in Sao Paulo myself without any help or subsidy from the tax authorities, who refused to contribute by at least withholding the withholding tax for a few months. 4 years ago I became completely dependent on sleeping pills due to insomnia, and also take heart and rheumatism medicines, which are not cheap either.

Thanks to a stay-at-home wife under 65 who gives her utmost for me and her mother who now also lives with us when her husband passed away a couple of years ago. That's why I'm not complaining, I don't suffer any acute problems, and I'm better off than most, but I also wanted to give MY contribution so that in the future Norway won't have to be called 'Uncle Skrue' in one of the world's richest countries.

Tore Christiansen

Administrator

THE OTIUM POST

EDITOR COMMENTS

In 1910, the Norwegian Government suddenly introduced a 15% tax on all

pensioners who decided to spend their old age in warmer climes, and also for marriage reasons. You were required to use a private lawyer to present your case all the way to the Norwegian High Court. Only then could we present our case to the ICC. As the Judges in both countries were allowed mutual telephone connection, the ICC Judge would get the first version and opinion from his Norwegian counterpart, and judge accordingly, NOT in accordance with MY presentation and opinion. A USELESS EFFORT!!

MY FIRST LETTER TO ICC, 09 June 2010